In terms of art itself, NFT is like a shortcut, more like a joke.

In the era without NFTs, the threshold of art was too high to reach. Artists spent ten years carving their works, cultivating their own style and language through experience, crossing single-plank bridges, crowding into galleries, exhibitions, and limited events, gaining favor at the cost of time.

Only when they have enough talent and are favored by capital can artists hope to rise to a higher level, write seven or eight-digit trading myths in the secondary market, and complete the incubation. The whole process is interconnected, one step at a time, and none of them are indispensable.

NFTs have infinitely compressed this process, and art has achieved an unprecedented low threshold and high dissemination. In a sense, the emergence of the meta-universe and its derivatives, NFTs, has rewritten the laws of the market. Brands, investment institutions, and opinion leaders in the traditional consumer sector are sensitive and vicious, and they are not stingy with enthusiasm. They have started a new marketing model.

The era breeds myths, and NFT is undoubtedly the product of the epidemic superimposed Web 3.0 period, which is unique.

In response to the booming European and American markets, Asian and even Chinese native IP is not to be outdone.

Taking the form of NFT promoted by a group of opinion leaders as an entry point, such as the BAYC boring ape avatar started by Chairperson Zhou and the Cryptopunk pixel series started by Yu Wenle, after paving the way for a high enough popularity of the public, they are not satisfied with continuing to "bring goods" for others, but self-develop and replay this trendy game.

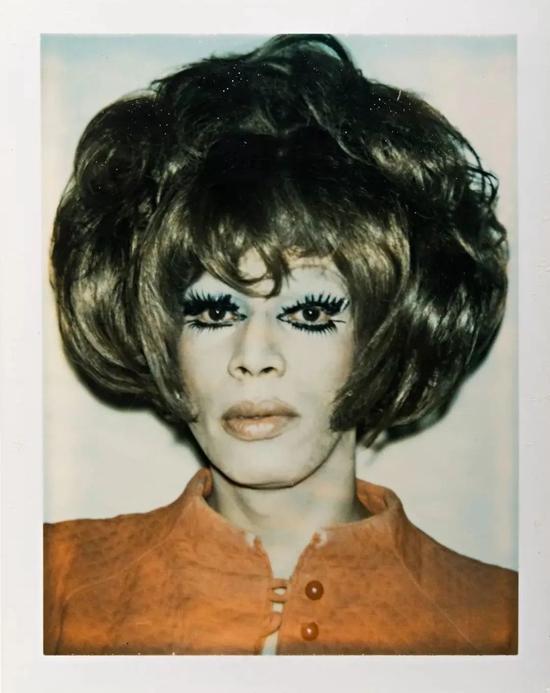

Among them, Edison Chen can be regarded as the most decisive one. From beginning to end, he has been regarded as a synonym for "not following the trend, and he is also the trend itself". By analyzing it as a sample, we can roughly glimpse the opportunities and predicaments of today’s NFTs.

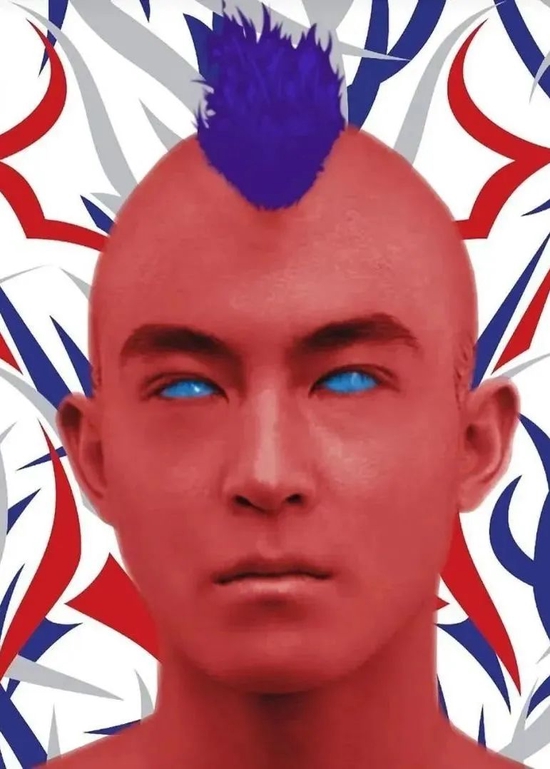

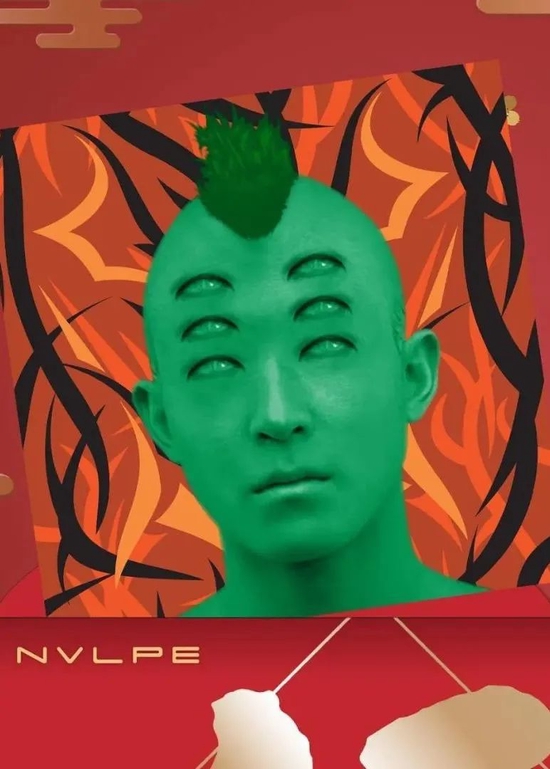

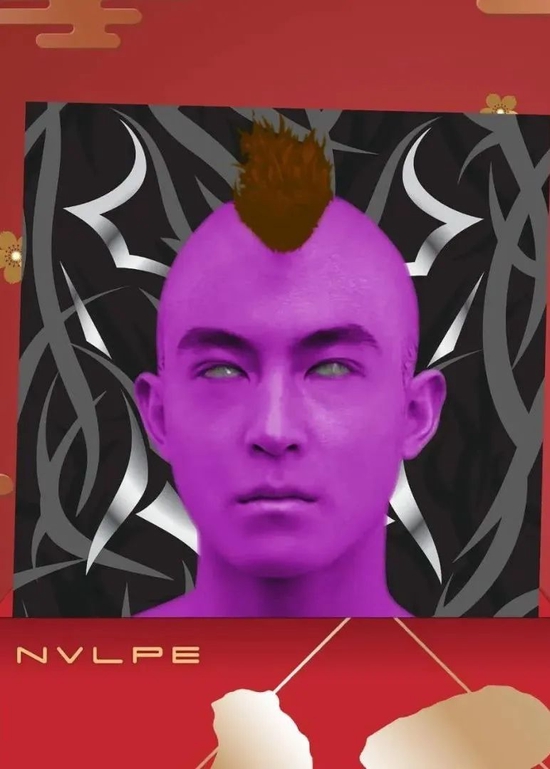

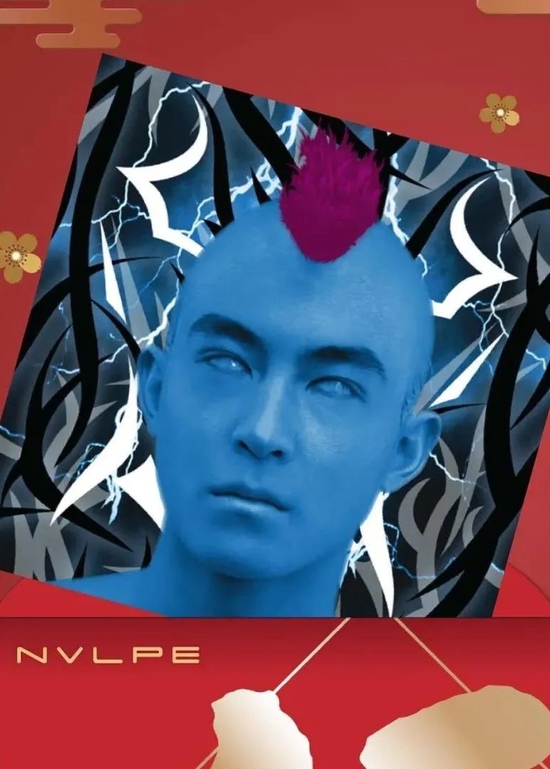

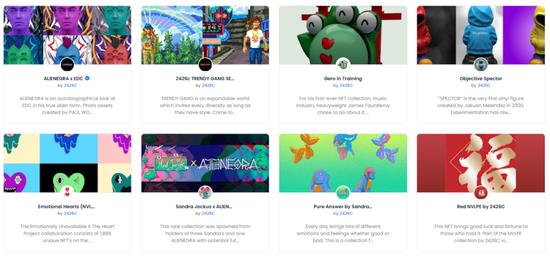

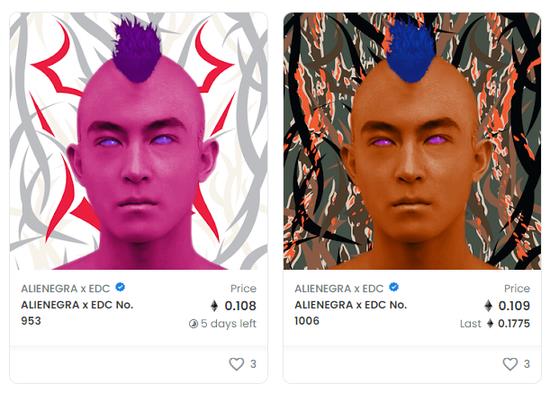

EDC first established platform 2426C to develop a series of virtual art products. The first round of products, RED NVLPE series, includes Dr. Woo, Heart NFT x Emotionally Unavailable, XIN YU, James Fauntleroy, CLOT, EDC x EGRA, Objective Collectibles, and Sandra Jockus, with a total of 8,888 artworks.

In the field of traditional art collection, Edison Chen is not a novice, so he entered the venue with a firm and upright attitude, knowing that in NFT art, NFT is a form, and the focus is on the art itself.

As well as tapping into different types of artists who can be distinguished, looking at completely different art combinations, claiming that his goal is "Gagosian in the field of NFT".

Gagosian, who has handled Picasso, Mondrian, and Andy Warhol, is known as the Nasdaq of the art world – implying that he is a system of exchange, setting prices and rules. The public can know that Edison Chen’s ambitions are great, and others may be playing with tickets. They follow the trend of fashion and add an identity title, but EDC is as serious as ever.

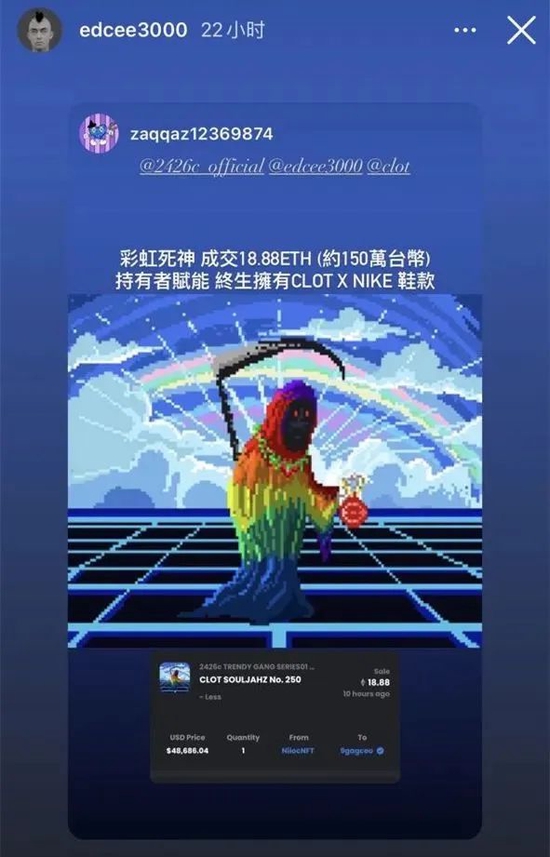

The fact is that he is really serious. Since the initial release of 2426C, he has personally released video tutorials, his wife and daughter appeared on the camera to promote, named other influential opinion leaders to help with platform delivery, and even empowered individual NFT holders with special rights – lifetime ownership of Clot x Nike shoes, etc., which can be said to spare no effort.

The process is gorgeous, the ending is bleak, the NFT issued by 2426C in February was sold at 0.1888ETH, plus the handling fee was about 4724 yuan, 8888 works brought nearly 38 million yuan of income to EDC, and the most popular EDC x EGRA, that is, the thorn product designed by himself as the prototype, has both popularity and visual effect, has fallen through the issue price, the lowest touch 0.108ETH, about 2012 yuan.

That is to say, the average investor who entered the market lost 2,162 yuan, and even the works of the other seven artists even fell to 0.03 ETH (about 558 yuan), leaving no one interested.

No matter how you look at it, it is far from "Gagosian in the field of NFT".

The shortcut was reflected. Bringing together these artists might have been a long project in the past, and the material and labor costs consumed in the middle were difficult to calculate. In the form of NFT, everything became very easy and full of black humor.

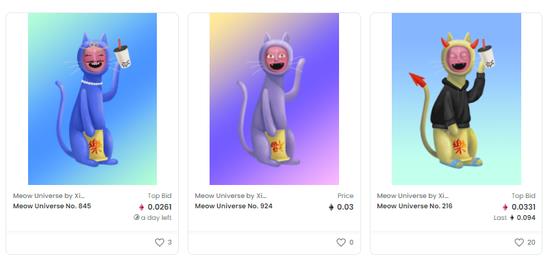

In fact, Edison Chen is just one of the most extreme example, his own brand value and influence is undoubtedly a pioneer, and it has fallen to this point. Most domestic NFTs are facing the same dilemma. Zhou Dong’s Phanta Bear and Yu Wenle’s ZOMBIE are all just passable, and well-known IPs such as Leng Rabbit and Ali have also been mocked by the group.

In the final analysis, the problems of domestic NFTs cannot escape the following basics: technical loopholes, far from the actual situation, fragmented operating methods, etc., which undoubtedly make themselves as vulnerable as a babbling baby in front of the huge NFT market in Europe and the United States.

What does a successful NFT capture when it captures the masses?

This form born in the meta-universe undoubtedly represents the public’s sense of identity with the Web 3.0 era environment. We aspire to become digital natives in the crypto world one day when the technology matures in the future, without any real differences in race, wealth, and social status.

Having the same NFT brings excellent narrative and background consensus, and finally creates a "sense of community", such as BAYC Boring Ape, which tells the story of a group of apes who became rich from cryptocurrency and inevitably fell into boredom forming a club, mirroring the current situation of ordinary people getting rich quickly from cryptocurrency in the real world, representing a native era culture.

In the Web 3.0 concept of "decentralization" and the egalitarian nature of the community, we use the simplest form – an avatar as an example, to find resonance with specific community members, while indulging in an artificially attached broad narrative to further create an immersive sense of enjoyment.

Coincidentally, not only domestic NFTs are still struggling, but the European and American markets where the meta-universe originated are also discussing whether "NFTs have stalled" – in March 2021, Jack Dorsey, the co-founder of Twitter’s CEO at the time, sold an NFT cast in December 2020, the content of which was the world’s first tweet published in 2006.

Then, the cryptocurrency entrepreneur Sina Estavi bought it for $2.90 million, which won the explosive traffic attention of the entire NFT form at that time. This NFT tweet was also called the "Mona Lisa of the digital age", which indirectly contributed to the rise of the entire market.

On April 7 this year, Sina intended to sell the OpenSea platform trademark at $48 million, and received a total of 7 bids after the first round of bidding period, with a minimum of 0.0019 ETH (about $5.8) and a maximum of 0.09 ETH (about $277).

From $2.90 million to $277, it seems like a myth died down, but behind it is the real awakening of the market: the gimmick brought by the NFT has been fooled by the public, even if the target is the "world’s first tweet", people are starting to care about the real value proposition of the NFT, that is, "I bought it, what else did I get except for it".

"Owning a pair of sneakers will allow me to find like-minded players, owning a trendy game will allow me to meet another half with the same taste, and owning an NFT will also give me more social capital."

A sense of belonging, a shared vision, a spontaneous voice for the group to which one belongs, eventually merged into a macro-sense "culture" – this is the same law that has never been outdated in the minds of the general public in any era.

关于作者