Wanda Film announced at noon on December 6 that the actual controller, Wang Jianlin, and others plan to transfer 51% of the company’s controlling shareholder, Beijing Wanda Investment Co., Ltd. (hereinafter referred to as Wanda Investment). If the above matters are finally implemented, it will lead to a change in the company’s control.

The announcement shows that the company received a notice on the same day that the company’s indirect controlling shareholder, Beijing Wanda Cultural Industry Group Co., Ltd., and its wholly-owned subsidiary, Beijing Hengrun Enterprise Management Development Co., Ltd., and the company’s actual controller, Wang Jianlin, intend to transfer 51% of the company’s total controlling shareholder, Wanda Investment, to Shanghai Ruyi Investment Management Co., Ltd. (hereinafter referred to as Shanghai Ruyi).

Wanda Film said that in view of the uncertainties in the above matters, in order to ensure fair information disclosure, safeguard the interests of investors, and avoid abnormal fluctuations in stock prices, the company has applied to the Shenzhen Stock Exchange to suspend trading of the company’s shares since the opening of the market on December 6, 2023 (Wednesday). It is expected that the suspension time will not exceed 2 trading days.

▲ Wanda Film Announcement

It is worth noting that, previously, Hong Kong stocks China Ruyi had announced on the evening of July 23 that, as a controlled structural entity in which the company holds 100% of the actual interests, Shanghai Ruyi was 2.262 billion yuan to transfer 49% of the shares held by Beijing Wanda Cultural Industry Group Co., Ltd. Wanda Investment.

China Ruyi said in the announcement that after the completion of the equity transfer, Shanghai Ruyi will directly hold 49% of Wanda Investment. Shanghai Ruyi currently has no intention to appoint directors of Wanda Investment and has no intention of participating in its daily operation and management. Wanda Investment will not be a subsidiary of China Ruyi.

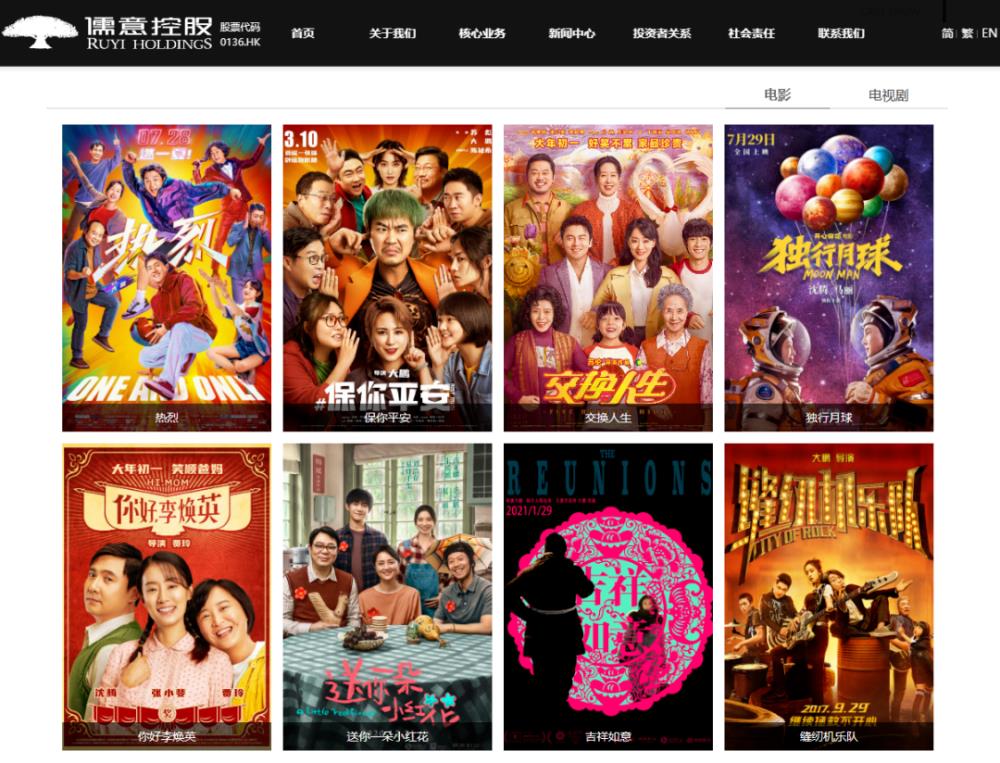

Shanghai Ruyi has produced many popular film and television dramas

Wanda Film is Wang Jianlin’s "quality asset".

Wanda Film’s third quarterly report data shows that in the first three quarters of this year, Wanda Film’s operating income was about 11.347 billion yuan, an increase of 46.98% year-on-year; the net profit attributable to the shareholders of listed companies was about 1.114 billion yuan. From January to September 2023, the company’s domestic theaters achieved box office 6.22 billion yuan (excluding service fees), an increase of 67.6% year-on-year, an increase of 5.2% over the same period in 2019; the number of moviegoers 150 million, an increase of 68.7% over the same period in 2019.

Data show that as of September 30, 2023, Wanda Film had 877 cinemas and 7,338 screens in operation in China, including 709 directly-operated cinemas and 6,159 screens, 168 light-asset cinemas and 1,179 screens. The company’s cumulative market share in the first three quarters was 16.5%.

According to public information, Shanghai Ruyi was established in 2013 and is mainly engaged in the production and operation of radio and television programs and film distribution business. It is a controlled structural entity in which China Ruyi holds 100% of the actual interests. The company has produced a number of popular film and television dramas such as "Hello, Li Huanying", "To Youth", "Langya Bang", "Biography of Mi Yue", "Sewing Machine Band" and "Send You a Little Red Flower". Previously, among the four cornerstone investors introduced by the IPO of Lehua Entertainment, Sun Mass Energy, a wholly-owned subsidiary of China Ruyi, had subscribed for the sale of shares of 7.90 million US dollars.

▲ Picture source: Ruyi company official website

It is worth mentioning that the largest shareholder of China Ruyi is Tencent. Including the previous introduction of China Ruyi, Wanda returned funds of 6.766 billion yuan through three equity transfers in July to dispose of Wanda Film and Wanda Investment Equity.

According to Wanda Film’s July 23 announcement on the change of indirect controlling shareholders’ equity, after the relevant equity changes with Shanghai Ruyi were completed, Shanghai Ruyi indirectly held 9.8% of Wanda Film’s shares through Wanda Investment.

At the same time, Wanda Culture Group indirectly holds a 10.2% stake in Wanda Film through Wanda Investment, and Wanda Culture Group and its concerted actors jointly hold a 21.1% stake in Wanda Film, both directly and indirectly.

That is to say, the controlling shareholder of Wanda Film is still Wanda Investment. Although Wang Jianlin sold his stake many times, he still retained his status as the actual controller of Wanda Film.

Why is Wang Jianlin selling?

Analysis believes that behind Wang Jianlin’s "selling, selling, selling" is the current financial dilemma that Wanda is facing and the short-term hopelessness of Zhuhai Wanda Commercial Management’s listing in Hong Kong stocks and the pressure of repurchase through gambling agreements.

According to the previous Hong Kong IPO application materials, Wanda Commercial Management Group subsidiary Zhuhai Wanda Commercial Management is applying for listing on the Hong Kong Stock Exchange. If it cannot be successfully listed by the end of 2023, Wanda Commercial Management Group needs to pay about 30 billion yuan to investors before listing.

As of the end of June 2023, the stock of domestic open market bonds managed by Wanda Commercial was 12.341 billion yuan, and the stock of overseas bonds was about 1.80 billion US dollars.

Wanda has sold at least five Wanda plazas this year. At the end of September, Wanda transferred its Guangxi Beihai Hepu Wanda Plaza to Hepu Wanghe Real Estate, a local real estate company in Beihai; in October, Wanda Commercial Management transferred a 100% stake in Shanghai Wanda Plaza Real Estate Co., Ltd.

On the secondary market, Wanda Film stopped trading on the 6th and closed at 12.45 yuan on the 5th, down 2.05% on the day, and the company’s latest market value was 27.13 billion yuan. As of press time, Hong Kong stocks China Ruyi rose 2.82% to 1.820 Hong Kong dollars, after rising more than 9%.

关于作者