People’s requirements for "face" are getting higher and higher, even to the point of harshness. "Yan value anxiety" was once one of the hot topics in the past.

Coupled with the improvement of economic strength, the beauty industry has experienced a period of rapid growth. According to the National Bureau of Statistics, the compound growth rate of retail sales of cosmetics above designated size reached 11.4% from 2017 to 2021.

At the same time, due to the environment, diet, aging and other reasons, most people do have different degrees of skin health problems, and the proportion of skin care products is also increasing. Domestic brands have launched a series of targeted skin care products by virtue of their in-depth understanding of Chinese skin, and their sales have also risen all the way. In 2021, the eight major beauty listed companies all recorded good revenue growth.

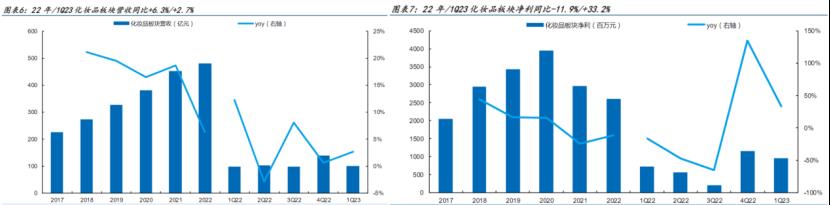

However, this scene changed in 2022, especially since the third quarter, many domestic beauty companies found that their products were becoming more and more difficult to sell. In 2022, the retail sales of cosmetics decreased by 4.5% year-on-year, and the situation of letting a hundred flowers blossom was long gone. Half of the companies fell into negative revenue growth.

(see the self-made map of intellectual research)

According to the research of Jianzhi, this should be analyzed from several aspects, and the external factor is the first one. Beauty cosmetics and skin care products are optional consumer goods. When faced with economic pressure or budget constraints, consumers may reduce their spending on non-essential items, so they are greatly affected by macroeconomics.

In addition, in the rapid development period of the past few years, in order to boost sales, e-commerce platforms have increased discounts and encouraged "the more you buy, the more discounts you get"; The traffic explosion of the super anchor also has some irrational consumption; Inventory that is difficult to sell in overseas epidemic situations enters China through cross-border e-commerce to consume inventory. Therefore, consumers’ household inventory is already at a high level, which is why we often hear that "what was bought in double 11 last year at 618 has not been opened".

In addition, the traffic dividends and platform dividends that have been discussed in the market in the past are also fading. This year, beauty companies and e-commerce platforms have become more rational. Like the 38 Goddess Festival in the first quarter of this year, Tmall did not make large-scale pre-sales and full reduction as before, and even the publicity was relatively low-key.

So, low growth will become the industry norm?

Let’s take a look at the performance of companies in the first quarter of this year. Who earns the most? Who has the strongest growth?

Overall, the overall environment of the beauty industry in the first quarter was still under pressure, and revenue only increased by 2.7% year-on-year (12.3% in the same period last year). However, the profit has been restored, and the net profit returned to the mother increased by 33.2% year-on-year (1% in the same period last year).

(Source: Guojin Securities)

Polaiya and shanghai jahwa were the most profitable companies in this quarter, with net profits of 210 million yuan and 230 million yuan respectively.

(see the self-made map of intellectual research)

As an outstanding student all the time, Polaiya continued its previous growth trend in the first quarter. For a detailed analysis, please refer to the previous article "The domestic beauty products are seriously divided, and Polaiya" wins hemp "with exclusive ingredients".

To put it simply, Polaiya’s highlight this year is the upgrade iteration of large items and the layout of new products, including cloud sunscreen and moisturizing series. In particular, the upgraded Shuangkang 3.0 was once again "sold out" and became the Top1 of Tmall’s liquid essence hot-selling list. According to the latest sales data in April, Polaiya’s growth is still steady. The GMV in Tmall flagship store and vibrato platform increased by about 54% year-on-year, so it is necessary to continue to pay attention to the sales of 618.

The performance of shanghai jahwa, another old brand of beauty cosmetics, has been unstable in recent years. Especially last year, due to the epidemic situation and the lack of super-anchor, both revenue and net profit returned to the mother decreased, and the net profit returned to the mother decreased by 27.29% year-on-year.

However, after entering 2023, shanghai jahwa’s income situation has improved (the income of skin care products in 22 /23Q1 was 1.98 billion yuan/410 million yuan, respectively, down by 26.8%/8.6%, and the decline was narrowed). In addition, with the new single product oil-sensitive cream, the sales data in April showed a rising trend. In the Tmall flagship store and Tik Tok, the GMV of Yuze and herborist brands increased by about 81% year-on-year, and the chain has also turned positive significantly (among them, the large single product oil sensitive cream contributed more than 20% in the GMV of Yuze Tmall flagship store; Tai Chi Repair Kit and New Seven Whitening Kit contributed over 35% to GMV in herborist Tmall flagship store).

The fastest growing beauty companies include Shuiyang and Marumi, in addition to Polaiya, which has just been mentioned. The net profit of these companies has increased by more than 20%.

Although Marubi shares have been affected by the external environment and the company’s promotion of online channel transformation in the past few years, the growth rate of net profit returned to the mother has been negative for three consecutive years. However, in the first quarter of this year, Marumi saw the effect of transformation, and the recovery growth continued until April.

In April, the total GMV of Marumi’s main brand in Tmall flagship store and Tik Tok Shanghai increased by 143% year-on-year, and the new recombinant collagen suit successfully ranked among the Top2 products in Tik Tok. At the same time, Love Fire also maintained rapid growth on multiple platforms, with a total growth rate of 180%, and the sales of explosive "invisible liquid foundation" accounted for about 30%.

The sales of Shuiyang shares also improved marginally. In April, the GMV of its brands, Royal Mud Workshop, Big Water Drop and Ifedan, increased by about 56% year-on-year. Among them, Ifidan’s Super Mask was successfully registered in Li Jiaqi Live Room, which promoted the GMV of its Tmall flagship store to increase by 823% year-on-year.

In addition, it is worth mentioning that although listed companies in Hong Kong stocks do not disclose a quarterly report, in the sales station in April, Juzi Bio and Shangmei also achieved good results. The "Fumei" and "Kelijin" of Juzi Bio increased by about 52% in Tmall flagship store and GMV in Tik Tok. The brand "Kanshu" of Shangmei Co., Ltd. is growing even more dramatically, with GMV increasing by about 229% year-on-year, and Tik Tok’s growth is as high as 320%. Its monthly sales rank second in Tik Tok’s beauty brand and first in domestic products.

Generally speaking, after four years of rapid growth from 2017 to 2021, the beauty industry is gradually entering a platform period, that is, the growth rate of the industry is relatively slow, and the differentiation among different brands is more serious. Although the leading company Polaiya still maintains a higher growth rate than the whole industry, the growth rate of Huaxi Bio and Betani, which used to have high growth, has obviously slowed down, and even some companies have fallen behind.

However, we also saw that companies such as Shuiyang and Marumi, which suffered serious losses in 2022, ushered in marginal improvement in the first quarter and April of this year.

So where is the next round of high growth? Which companies can seize the opportunity?

As we all know, in the period of rapid growth of the beauty industry, major brands will invest a lot of marketing expenses and constantly introduce new products in order to seize market share. However, as the market entered the platform period, both the brand and the platform began to be more rational, and the focus returned to the product itself.

Take Huaxi Bio as an example, the sub-brand Quadi used to grow at the rate of doubling every year, but since 2022, the growth rate has slowed down obviously. In the first quarter of this year, Huaxi’s growth was still under pressure from the launch of new products, and there was no obvious upward trend. This year, the company also took the initiative to reduce the revenue growth target to 15%-20%.

What is more important for Huaxi this year is to enhance brand value. In order to make the new anti-aging eye cream quickly occupy consumers’ minds, Quadi even made a detailed interpretation of the market trend, and took the new packaging technology as a selling point, claiming that it could promote the penetration of active ingredients, thus greatly increasing the customer unit price (the new product "Zhen Jin Yun Huo Eye Cream" was 498 yuan /20g, while the old green obsidian eye cream was 238 yuan /18g).

According to Jianzhi research, the purpose of a lot of market research and publicity in Quadi’s early stage is to establish a professional and reliable image and make anti-aging more deeply rooted in people’s hearts. The addition of new technology and the upgrading of efficiency are all important means to increase the unit price of customers. At present, the new eye cream ranks second in Taobao’s new product list, second only to L ‘Oré al 20 Eye Cream, but the actual sales volume and use effect need to be continuously tracked.

Similar to Huaxi’s biological situation is Betani. This year, Bettini focused on upgrading Winona Shu Min Moisturizing Cream and promoting the high-end brand AOXMED. In the future, consumers will make immediate repairs after finishing medical beauty, which may not only use dressings, but also use more essences and creams to enhance their efficacy.

Another great event of Betani is that she clearly put forward the idea of getting into the beauty of military doctors in last year’s annual report.

According to the knowledge of Jianzhi Research, Betani is making efforts to the track of life beauty instrument.

Before, home beauty instruments were on fire in the market for a while, but due to several safety accidents, home beauty instruments were subject to stricter supervision. Among them, pulsed light hair removal products have been classified as Class II medical devices, and RF products with higher risk factors have been included in Class III medical devices for management since last month.

Betani is likely to get the certificate of Class II medical devices first, and then gradually expand to the beauty instrument of Class III medical devices. In fact, the life beauty instrument track has a large room for growth, and specialization and standardization will become an inevitable trend, which may open up new growth points for Betaine in the future. At the same time, the company will definitely introduce skin care products that match the beauty instrument, because the purchase frequency of the beauty instrument is relatively low, and the matching skin care products can be supplemented frequently.

Generally speaking, the beauty industry is stepping into the platform period from the high-speed growth period, which is mainly reflected in the slowdown of the overall industry growth, the performance differentiation among different brands and the difference in development focus.

With the continuous development of dermatology, products will be more refined and provide precise solutions for different skin needs. Future competition will pay more attention to the application of core needs, dermatology and precision technology. Brands need to focus on the mental cultivation of consumers and the layout of new products in order to gain a competitive advantage in the next growth period.

This article is from Wall Street. Welcome to download the APP to see more.

关于作者