On the eve of the National Day (September 30), a new sub-brand – Buick Avenir was officially launched. According to SAIC GM’s strategic intention, the new brand will be specially built based on Buick’s high-end models, providing consumers with high-end and personalized car needs and exclusive service experience.

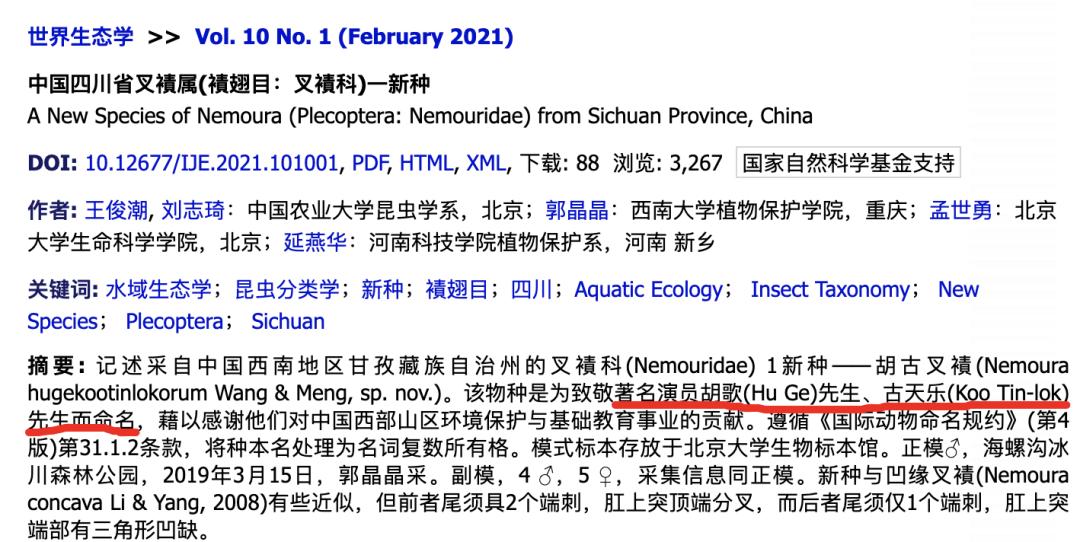

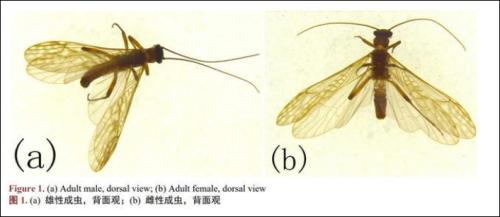

Avenir concept car built by Buick’s global team

Avenir concept car built by Buick’s global team

In fact, it is not surprising that SAIC GM has taken this step. The launch of Buick Avenir is a more substantial step for Buick to advance to the high-end field in recent years. In fact, Buick has launched high-end models such as Rongyu and other high-end models before. At the Boao Forum for Asia in 2008, the organizers chose Buick Boulevard as the "only designated VIP car". Buick has also been leveraging cultural and artistic platforms to enhance brand perception, and a series of brand promotion and sponsorship activities have indeed effectively solidified the foundation of Buick’s brand’s continuous improvement.

The practice of providing high-end models through the release of sub-brands on the basis of existing models is actually not unique to Buick. For example, the version of the model, such as the Vignale version, and then looking back, you can also find the Ford Ghia brand. If we expand the definition of sub-brands from high-end to sports, we will also include such things as the Polaris series, series, etc. The case has proved that the introduction of sub-brands can quickly increase brand influence and model awareness.

However, all of this is also conditional.

First of all,The premise of enhancing brand influence through the launch of high-end sub-brands is that the brand itself requires basic brand power.

When we turn back the clock of history, we always find the intersection of Buick and the upper class. General Zhang Xueliang’s special car was a Buick, and President Roosevelt’s gift to Qingling was a black Buick, Premier Zhou’s exclusive car or a Buick.

As one of the early brands to enter the Chinese market, the Buick brand has gained a certain reputation in the luxury car market in the early years by virtue of the advantages of imported cars and the early domestic Buick Century and other models. Subsequently, with the launch of a series of family sedans such as Buick, the Buick brand has also completed a wider coverage of the brand, realizing the transformation of Wang Xie in the old days and flying into the homes of ordinary people. After more than ten years of hard work, the Buick brand has become one of the most influential mainstream brands in the Chinese auto market. Many consumers regard Buick as a mid-to-high-end brand, which is the basis for the brand to continue to improve.

In recent years, Buick has improved its market share and brand span through the rapid update of models and the continuous enrichment of its product lineup. At present, the Buick brand has completed the layout of three major car series: high-end comfortable models, high-end coupes, and high-end SUVs, and has opened the product layout of "Buick Blue" new energy vehicles, which constitutes the first premise for the release of the Avenir sub-brand.

Secondly,Brands must have sufficient product strength and sales to support the development of high-end sub-brands.

Compared with the parent brand, the sub-brand is still a niche after all, not to mention that the sub-brand of Buick Avenir still relies on the development idea of the parent brand’s existing models. Therefore, this puts forward higher requirements for the sales and product strength of the parent brand.

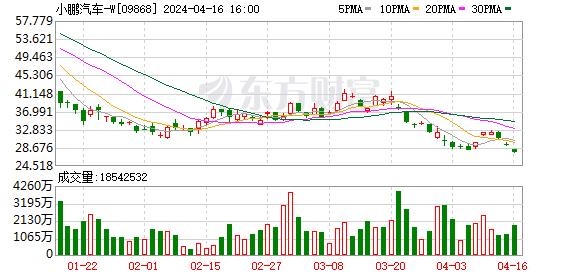

Let’s take a look at Buick’s recent market performance.

According to relevant data, in the first three quarters of this year, the brand completed sales of 870,104 vehicles, an increase of 26.89% year-on-year. In the most recent August and September, the SAIC-GM Buick brand completed monthly sales of more than 100,000 vehicles for two consecutive months. In terms of sub-models, 26,448 vehicles were sold in September, 8,999 vehicles were sold, 8,000 vehicles were sold, 36,386 vehicles were sold, 17,992 vehicles were sold, and 56,333 vehicles were sold in the first three quarters. Among them, Envision’s sales in September increased by 82.2% year-on-year, setting a record high in sales for the month. The cumulative sales in January-September reached 18,028 vehicles, successfully occupying the first position in the joint venture SUV market.

The SUV market is currently the fastest growing market in the domestic market. According to the statistics of the China Association of Automobile Manufacturers, the average growth rate of the SUV market is more than 50%. In this segment, the Buick Envision is in the first camp of the sales rankings and is one of the few joint venture SUVs in the top ten SUV sales rankings.

From the product point of view, the success of the Buick Envision lies in cleverly grasping the connection point between the mid-range SUV and the compact SUV, which is the pain point of the joint venture SUV market. Take the mainstream compact SUV as an example. Under the standard styling ratio, the compact SUV, especially the joint venture brand’s compact SUV, often has the disadvantage of small size and space. The mid-range SUV above this has caused young consumers to have some concerns because of its excessive size. The appearance of the Envision just solves this contradiction.

In fact, I think the Envision’s positioning is still very forward-looking. This level of SUV is a huge market that is rapidly heating up, and in addition to the Envision, there will be more models to join the competition in the future. For example, the Kodiaq just unveiled at the Paris International Motor Show this year, and the new generation of long-wheelbase Tiguan that is about to debut, the new generation of fully enlarged size, and so on.

In the large MPV market, no one can shake the position of the Buick GL8. The success of the Buick GL8 lies in providing a very rich selection of product camps in the MPV market to adapt to diverse consumer needs. The upcoming new generation GL8 also realizes comprehensive coverage from the business MPV market to the high-end private MPV market. Such volume is rare in the current MPV market. For example, the smaller size has always been a household attribute that is larger than the business attribute. In addition, from the perspective of the product, in the MPV market, the Buick GL8’s driving texture will better fit the market’s perception of MPV, including the smoothness of the power, the comfort of the chassis, and so on.

From a design perspective, the success of the new LaCrosse lies in the deepening of American design. The design of the new generation of LaCrosse brings the design of traditional American luxury cars into the design language. The interior pays attention to a comprehensive sense of wrapping and the use of warm colors. In the exterior design, sculptural aesthetics are integrated into the design to stretch the lines of the whole car. The posture of the new LaCrosse is highly consistent with the positioning of its mainstream consumer population, which is the key to its success.

In the family car market, New Yinglang has been a dark horse since its launch last year. The key to success in this market segment is actually two points. To create a well-balanced sedan under a good brand, New Yinglang has indeed achieved this. On the other hand, Valeant is on this basis to emphasize the quality of the vehicle itself and better cater to the overall positioning of the Buick brand.

In terms of the application of new technologies, the Buick brand has always been a pioneer in in-vehicle technology upgrades. For example, the first generation of the OnStar system pioneered in-vehicle intelligence. At present, Buick is also a loyal fan of green intelligent technology. The latest generation of in-vehicle intelligent interconnection system integrates 4GLTE, Apple CarPlay, Baidu CarLife and other interconnection functions. And this series of Internet technologies has been rapidly popularized in Buick’s models, providing users with a car experience in the Internet + era. Therefore, whether it is from the perspective of the overall sales volume of the Buick brand, the positioning of sub-models and the application of new technologies, the Buick brand has the scale to support a high-end sub-brand.

And thirdly,The improvement of service level is a necessary condition to support the development of high-end sub-brands.

If the product itself is regarded as the hardware facilities that support the development of high-end sub-brands, then the service is the software facilities behind it. Especially for high-end sub-brands like Buick Avenir that rely on the development of the parent brand, the premise of its birth is that the service of the parent brand meets its high-end needs.

In the field of after-sales services, Buick has indeed always paid attention to the shaping of brand perception. In 2002, Buick created China’s first after-sales services brand "Buick Care", which brought automotive after-sales services from traditional passive services to the era of active care, emphasizing the initiative of after-sales services. In May this year, Buick Care released a new brand identity and launched a series of innovative service projects. To comprehensively improve the service experience and provide users with a more contemporary service concept, the upgrade of "Buick Care" is also an important step to enhance the value of the Buick brand. With the launch of the Avenir sub-brand, it is expected that Buick Care will also launch exclusive services for the Avenir sub-brand.

It is not difficult to find that the release of the Buick Avenir sub-brand is accompanied by the overall improvement of the Buick brand’s brand influence, product strength and service capabilities, which is also an inevitable development of the brand. In turn, the release of the Avenir sub-brand will further meet the needs of the Buick brand in the high-end consumer market after the brand power is enhanced, which complement each other.

So, to answer the question raised by the title of this article, the answer is yes. For Buick, now is indeed the time to break through. Of course, shaping a new sub-brand also requires the baptism of the market and time, we will wait and see.

Avenir concept car built by Buick’s global team

Avenir concept car built by Buick’s global team