Neijiang, Sichuan, three days before the college entrance examination, senior three students took a group photo in the classroom. Bright pictures/vision china

editorial comment/note

The 2018 college entrance examination starts today.

This year, the first batch boarded the college entrance examination arena after 00;

This year, due to the integration of vocational colleges and other factors, the number of registered candidates reached 9.75 million, an increase of 350,000 over last year, the largest number of candidates in the past eight years;

This year, many provinces have announced new college entrance examination plans. With the reform of college entrance examination, only the situation of liberal arts and science has been broken, and students’ right to choose has expanded dramatically.

China Education Online recently released the "Investigation Report on 2018", which allows us to perceive the new changes and trends of the college entrance examination through data and charts.

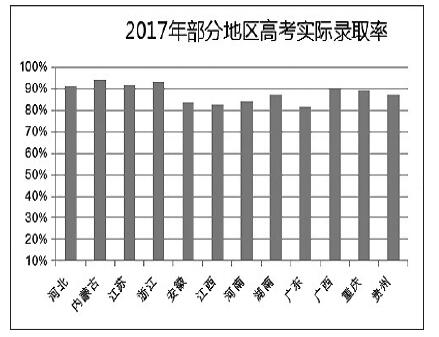

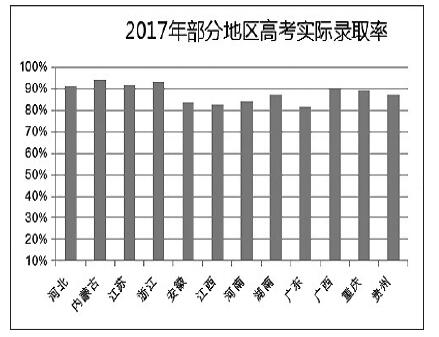

1. The proportion of admission is rising, and the contradiction of further education is basically solved.

The number of applicants for the college entrance examination ushered in an inflection point, and the number of students studying abroad continued to rise.

The number of applicants for the national college entrance examination dropped sharply after reaching the historical peak of 10.5 million in 2008, and it began to stop falling and stabilize in 2014. According to the statistics of the Ministry of Education, the number of applicants for the national college entrance examination in 2017 totaled 9.4 million, the same as in 2016. The number of applicants for the national college entrance examination has been stable at around 9.4 million for four consecutive years. In 2018, the number of applicants for the college entrance examination ushered in another growth, hitting a new high in eight years.

However, in the long run, the basis of college entrance examination students has not changed fundamentally. In 2014 and 2015, the enrollment of ordinary high schools remained at the level of 7.97 million, and in 2016, the enrollment of ordinary high schools was 8.03 million, with little change. At present, the increase in the number of applicants for the college entrance examination should be mainly due to the country’s emphasis on vocational education and the continuous opening of secondary vocational education channels in various places.

According to demographic data, the national birth rate has been declining since the 1980s. China’s birth population reached its peak in 1990, exceeding 26 million. Since then, the number of newborn babies in China has shown an obvious downward trend. In the past ten years, the number of newborns has been below 16 million for a long time. Stimulated by the two-child policy, it rose by 1.31 million in 2016, but it fell by more than 630,000 in 2017 and fell to 17 million again.

At the same time, according to the latest data released by the Ministry of Education, in 2017, the number of Chinese students studying abroad exceeded 600,000 for the first time, reaching 608,400, an increase of 11.74% year-on-year, and continued to maintain the status of the world’s largest source country for international students.

The admission rate has risen steadily, and many places have reached new highs.

According to the statistical bulletin of national economic and social development in 2017 published by the National Bureau of Statistics, in the 2017 college entrance examination, there were 7.615 million students enrolled in general colleges, and the actual admission rate of the national college entrance examination reached 81.01%. The proportion of college entrance examinations in various places has been rising, and the contradiction of further education has been basically solved.

The actual admission rate in Henan Province continues to rise.

In 2017, the total number of applicants for the Henan college entrance examination was 865,800, an increase of 45,300 compared with 2016, still ranking first in the country. This is also the third consecutive year that the number of applicants for the college entrance examination in Henan has rebounded sharply after six consecutive losses.

As one of the areas with the lowest admission rate in the national college entrance examination, the actual admission rate of Henan college entrance examination has continued to rise in recent years. In 2016, the actual admission rate was 85%, a record. In 2017, a total of 728,500 freshmen were enrolled, and the actual admission rate was 84.14%, which was still at a high level.

The actual admission rate in Shandong Province is above 80% on the whole.

According to the data released by Shandong Education Admissions Examination Institute, a total of 683,200 people (including the spring college entrance examination) took the college entrance examination in Shandong in 2017, a decrease of 26,600 compared with 709,900 in 2016. This is the first time that the number of applicants for the Shandong college entrance examination has dropped after four years of continuous increase.

Since 2011, the actual admission rate of Shandong college entrance examination has been above 80%. 2011 — It reached a high point in 2013, then fell back and began to pick up in 2016. In 2017, the total number of students enrolled in the Shandong college entrance examination was 580,400, and the actual admission rate of the college entrance examination was 84.95%, an increase of 2.8 percentage points over 2016.

Jiangsu Province has not completed the enrollment plan for four consecutive years.

In 2017, the number of applicants for the college entrance examination in Jiangsu was 330,100, a decrease of more than 30,000 compared with the previous year. This is the eighth consecutive year that the number of applicants for the college entrance examination in Jiangsu has decreased, a decrease of more than 210,000 compared with 2009.

Since the number of colleges and universities in Jiangsu ranks first in the country, in 2016, there were even more enrollment plans than applicants.

In 2017, the total enrollment plan of Jiangsu college entrance examination was 323,600, and finally 303,400 people were admitted. The actual admission rate was 91.91%, a record high. However, there are still more than 20,000 enrollment plans unfinished, which is the fourth consecutive year that Jiangsu has not completed the enrollment plan.

Hebei Province has achieved double growth in the number of applicants and the actual number of students admitted to the college entrance examination for three consecutive years.

According to the data released by Hebei Education Examinations Institute, the number of applicants for Hebei college entrance examination in 2018 was 486,400, a year-on-year increase of 50,200, rising for the third consecutive year. In 2017, 401,200 candidates were actually enrolled in Hebei college entrance examination, and the actual number of students enrolled exceeded 400,000 for the first time, achieving double growth in the number of college entrance examination applicants and the actual number of students admitted for three consecutive years.

In 2016, the actual admission rate of Hebei college entrance examination exceeded 90% for the first time, and in 2017 it exceeded 91%.

On the one hand, the number of people admitted to the college entrance examination in Hebei and the admission rate have maintained a double growth, on the other hand, the plan of high-tech recruitment has not been completed for five consecutive years. In 2017, a total of 1,674 colleges and universities nationwide enrolled students in Hebei Province, with a total of 408,700 undergraduate and specialist programs, and 401,200 candidates were actually enrolled, with a total unfinished amount of 7,500.

Due to various reasons, it has been common in all parts of the country to fail to complete the enrollment plan. Although the actual enrollment ratio fluctuates, it is obviously not caused by insufficient enrollment plan, but more because candidates give up the opportunity to study.

2. The scale of independent enrollment is stable and the competition is fierce

As an important measure of the reform of college enrollment system, autonomous enrollment expands the ways and channels of scientific talent selection, so that those students with academic expertise and innovative potential have more opportunities to receive college education.

The admission rate of independent enrollment is at a low level.

In recent years, with the growth of the number of self-enrollment applicants, the number of self-enrollment applicants who have passed the examination is also on the rise. According to the public information of Sunshine College Entrance Examination Platform, the number of people who passed the examination of independent enrollment in many first-class universities, including Tsinghua University and Peking University, increased in 2018 compared with the previous year.

According to the requirements of the Ministry of Education, the number of self-enrollment can’t exceed 5% of the total annual undergraduate enrollment plan of pilot schools. Therefore, with the increase in the number of applicants and the overall stability of self-enrollment plans of colleges and universities, the competition for self-enrollment will become more intense.

According to the public information of Sunshine College Entrance Examination Platform, the number of independent enrollment plans of Fudan University in 2017 does not exceed 155, and the actual enrollment is 58, which is 97 people different from the maximum number of enrollment plans; The number of independent enrollment plans of Zhejiang University in 2017 does not exceed 320, and the actual enrollment is 166, which is 154 people different from the upper limit of enrollment plans; In 2017, Xiamen University enrolled 262 students independently, and actually enrolled 127 students, which was 135 people different from the upper limit of the enrollment plan. Obviously, all schools are strict in the implementation of national policies and basically control them within the scope.

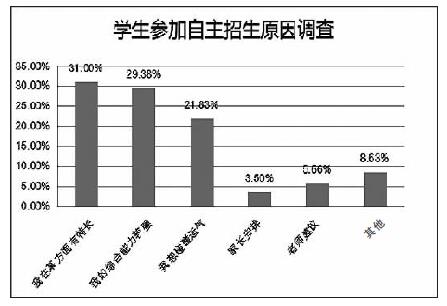

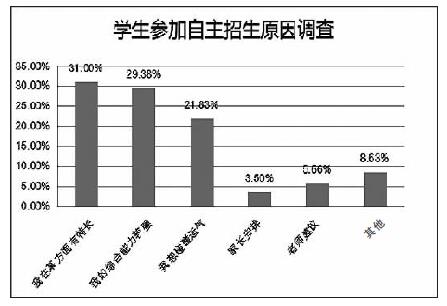

Most students are willing to participate in independent enrollment.

Although the competition for self-enrollment is becoming increasingly fierce, most students are still keen to participate in self-enrollment because of the reduction of exam difficulty and the reduction of score discrimination. According to the self-enrollment survey conducted by China Education Online for senior high school students, 80% of the students indicated that they have plans to participate in self-enrollment in the future.

According to the survey, students’ strong comprehensive ability and expertise in some aspects are the main reasons for encouraging them to participate in independent enrollment, accounting for 60.38%.

Zhejiang’s "Trinity" enrollment model is favored by colleges and universities.

In 2011, Zhejiang began to try the "trinity" enrollment model in provincial colleges and universities, that is, the candidates’ scores in the national examination, the test scores of candidates in colleges and universities and the college entrance examination scores were converted into comprehensive scores according to a certain proportion, and then they were selected for admission. This recruitment model takes care of the traditional college entrance examination, middle school evaluation, college evaluation and other multi-dimensional evaluations to the greatest extent, and effectively supplements the deficiency of the traditional college entrance examination, which is favored by colleges and universities.

In 2017, Zhejiang’s "Trinity" comprehensive evaluation enrollment, in addition to more than 40 universities in the province, there are also 8 universities outside the province and affiliated universities to participate in enrollment. These eight schools are Peking University, Tsinghua University, Fudan University, Zhejiang University, Shanghai Jiaotong University, China University of Science and Technology, University of Chinese Academy of Sciences and Chinese University of Hong Kong (Shenzhen), with a total enrollment plan of 1,554 students.

According to the information disclosed on the enrollment websites of various schools, in 2017, Tsinghua University enrolled 150 people in Zhejiang, including 105 candidates in the "Trinity", accounting for 70%; China University of Science and Technology plans to enroll 115 students in Zhejiang in 2017, including 100 students enrolled in the Trinity Program, accounting for 86.95%. In 2017, the University of Chinese Academy of Sciences planned to enroll 41 students in Zhejiang, including 39 students enrolled in the "Trinity" program, accounting for 95.12%.

However, considering the technical difficulty of specific practice, it is unlikely that this model will be implemented on a large scale.

3. The pilot provinces of the new college entrance examination reform explore ways to comprehensively promote the college entrance examination reform.

In 2017, the new college entrance examination reform successfully landed in Shanghai, Zhejiang Province, which provided useful experience for comprehensively promoting the college entrance examination reform in the next step. In November 2017, the People’s Government of Zhejiang Province issued "Several Opinions on Further Deepening the Comprehensive Reform of College Entrance Examination" (hereinafter referred to as "Opinions"). The reform scheme has been improved, especially the comprehensive and systematic adjustment of the high school academic level test, which has effectively solved the problems of class selection, examination frequency and the decline of the number of physics candidates.

Students choose diversification, and only 10% and 17% choose traditional arts and sciences.

The reform of college entrance examination has expanded students’ right to choose, breaking the previous limit of only two choices: liberal arts and science. According to statistics, in 2017, the number of students who chose traditional science subjects in Zhejiang dropped from 63% to 17%, and the number of students who chose traditional liberal arts subjects dropped from 37% to 10%. More students chose three elective subjects, which fully reflected individuality and diversity.

After the reform measures of Zhejiang new college entrance examination are improved, the advantages of physics examiners are fully reflected.

Students’ independent choice of subjects not only shows students’ personality, but also brings the problem of physics "being cold". According to the statistics of Zhejiang Education Examinations Institute, in the 2017 college entrance examination, among the 291,300 college entrance examination students in Zhejiang (250,100 students enrolled in ordinary colleges and universities, 41,200 students enrolled in separate examinations, and the number of students enrolled in examinations can only be based on the number of students enrolled in ordinary colleges and universities), the number of students enrolled in physics is 89,500, accounting for 35%.

In the new college entrance examination held in November 2017, the number of physics students in the third year of high school in 2018 declined again. According to the data released by Zhejiang Education Examinations Institute, the number of students enrolled in the 2018 senior three exams was more than 255,000, including more than 73,000 in physics, accounting for less than 30%.

The decline in the number of physics candidates in Zhejiang’s new college entrance examination has aroused widespread concern in society. In fact, according to the requirements for major selection of more than 1,400 colleges and universities enrolled in Zhejiang in 2014, if you choose physics, 91% of the majors are unrestricted, ranking first in all subjects. However, because of the low input-output ratio of physics, the number of students who choose physics is not as good as biology and chemistry, ranking second from the bottom.

In November 2017, the People’s Government of Zhejiang Province issued "Several Opinions on Further Deepening the Comprehensive Reform of College Entrance Examination". According to the "Opinions", Zhejiang will establish a guarantee mechanism for elective subjects in the future, of which the number of physical elective subjects is 65,000. That is to say, once the number of students assigned to an examination of physics subjects is less than the guaranteed number, the guarantee mechanism will be started, with 65,000 as the base, and the scores will be assigned from high to low according to the prescribed proportion.

In order to effectively guide candidates’ parents to make rational choices and promote students’ all-round development, the Ministry of Education issued the "Guidelines on the Requirements for Undergraduate Admissions in Colleges and Universities (Trial)" (hereinafter referred to as the "Guidelines of the Ministry of Education") in early 2018. At the beginning of May, Zhejiang Education Examinations Institute issued a notice, requiring that from the year of enrollment in 2020, the elective subjects of relevant majors in colleges and universities should be determined according to the Guidelines of the Ministry of Education, and some professional candidates must meet two or three elective subjects at the same time.

According to the statistics published by Zhejiang Education Examinations Institute, among the more than 27,000 majors to be enrolled in Zhejiang in 2020, the number of majors limited to physics accounts for 22.17% of all enrollment majors. In the previously published "Scope of Selected Subjects for Majors (Classes) in Zhejiang Colleges and Universities in 2017", the proportion was only 3.9%. It can be seen that the number of physics majors required to be selected has increased significantly.

At the same time, relevant departments have also studied and adjusted the scoring method to attract candidates to apply for "low input-output ratio" subjects such as physics, guide rational choice and grow in an all-round way.

Under the guidance of the above comprehensive measures, the phenomenon of the decline in the number of physics candidates has been effectively curbed, and the emergence of similar phenomena in other subjects has been put an end to.

Most candidates give up physics because of their "high difficulty and low score" and fear of losing money in admission. Judging from the actual admission situation in 2017, the candidates who took the physics exam not only did not suffer losses, but also had advantages.

According to the data released by Zhejiang Education Examinations Institute, among the candidates admitted in the first paragraph, 59% took the physics exam. In the 985 and 211 colleges and universities, 74% of the candidates took physics, especially the undergraduate admission rate of those who took physics was 72%, which was 21% higher than that of those who did not take physics.

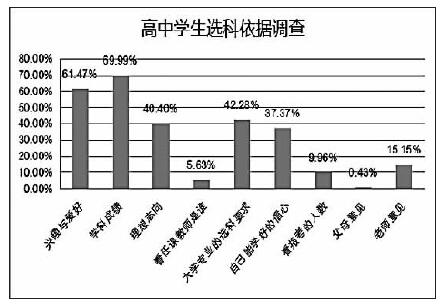

Some students are utilitarian in choosing subjects, so a scientific guidance system should be established as soon as possible.

In the new college entrance examination reform, students are given the right to choose in order to fully display their personality hobbies. However, in the actual choice, the candidates’ choice motivation is obviously utilitarian.

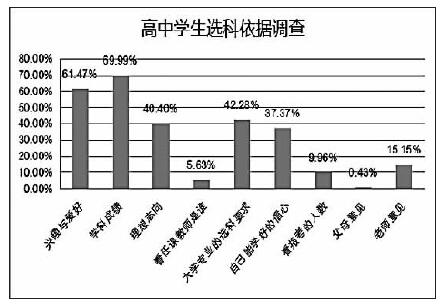

In a multi-choice conducted by China Education Online for senior high school students, the number of students who choose subjects according to their academic achievements is the largest, accounting for 69.99%, followed by students who choose subjects according to their interests and hobbies, accounting for 61.47%, and students who choose subjects according to the requirements of university majors account for 42.28%.

Choosing subjects that you are good at in order to get higher marks directly affects students’ choice of colleges and majors. According to the questionnaire survey conducted by China Education Online, 67.1% of students will adjust their target colleges or majors according to their own advantages when there is a conflict between the requirements of the subjects selected by the target colleges and universities and the subjects they are good at. Only 14.72% students will adjust their elective subjects according to the requirements of colleges and universities.

The new high exam forces colleges and universities to do something, characteristic colleges and universities counterattack, and the enrollment pressure of non-dominant majors is great.

The change of the examination rules has led to great changes in the admission rules, not only canceling the batch, but also emphasizing the professional characteristics in the mode of "major+university" in the new college entrance examination in Zhejiang. This new system design has effectively broken the identity boundaries of the original universities, such as 211 and 985, and provided opportunities for universities with strong discipline characteristics to surpass them.

When Zhejiang invested in the first paragraph in 2017, some of the original "two universities" entered the first paragraph, and some of their professional investment scores even exceeded 211,985 universities.

In the same way, the new college entrance examination also provides colleges with this possibility of transcendence. In the process of admission to the new college entrance examination in Zhejiang in 2017, some professional investment lines of many specialized colleges surpassed those of undergraduate colleges. For example, zhejiang financial college’s digital media application technology major scored 532 points, Zhejiang Medical College’s pharmaceutical equipment application technology major scored 529 points, Zhejiang Textile and Apparel Vocational and Technical College’s urban rail transit electromechanical technology major (Ningbo Metro Order Class for Urban Rail Transit Communication) scored 528 points, Tianjin Medical College’s medical imaging technology major scored 523 points, and Anhui Vocational College of Police Officers’s legal affairs major scored 520 points, all of which were 40 points higher than the second section of Zhejiang.

The new college entrance examination not only provides counter-attack opportunities for ordinary universities with strong discipline characteristics, but also sounds an alarm for some majors with unclear advantages in high-level universities.

In the college entrance examination in Zhejiang in 2017, there was a big gap in the professional investment scores of some former 985 and 211 universities. In the same school, the difference between the highest investment line and the lowest investment line among majors was as high as 60 points. For example, the professional score of Beijing University of Chinese Medicine is 65 points; The professional score of Northeast Normal University is 61 points; Southwest Jiaotong University’s professional score is 55 points; The professional score of Sichuan University is 49 points; China Geo University (Wuhan) scored 45 points.

According to the statistics of admission data of some colleges and universities over the years, Southwest Jiaotong University’s admission line in Zhejiang in 2016 was 36 points (regardless of arts and sciences), and in 2017 it was expanded to 55 points (regardless of arts and sciences); In 2016, Sichuan University scored 25 points (regardless of arts and sciences) in the admission line for enrollment majors in Zhejiang, and in 2017 it expanded to 49 points (regardless of arts and sciences).

(Author: Chai Long, Wu Fuping, editor-in-chief of China Education Online College Entrance Examination Research Center)