Since the 19th century, virus therapy for cancer has been studied. However, due to technical barriers and safety problems in genetic engineering, great progress has not been made until the last 20 years. At present, viralvectors for gene therapy and oncolytic viruses (OVs) are the main methods used by viruses as tumor therapy. The main difference between gene therapy virus vector and OVs is that the virus used in gene therapy virus vector is a non-replicating virus, while the vector used in OVs is a virus with replication ability.

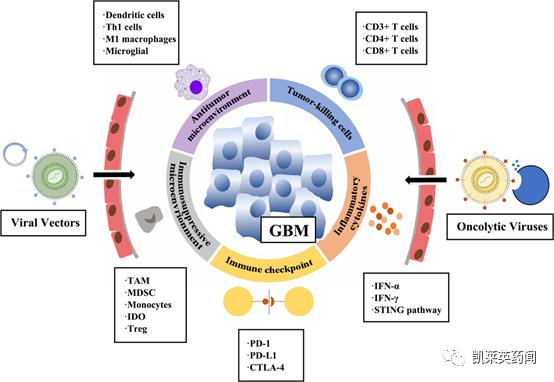

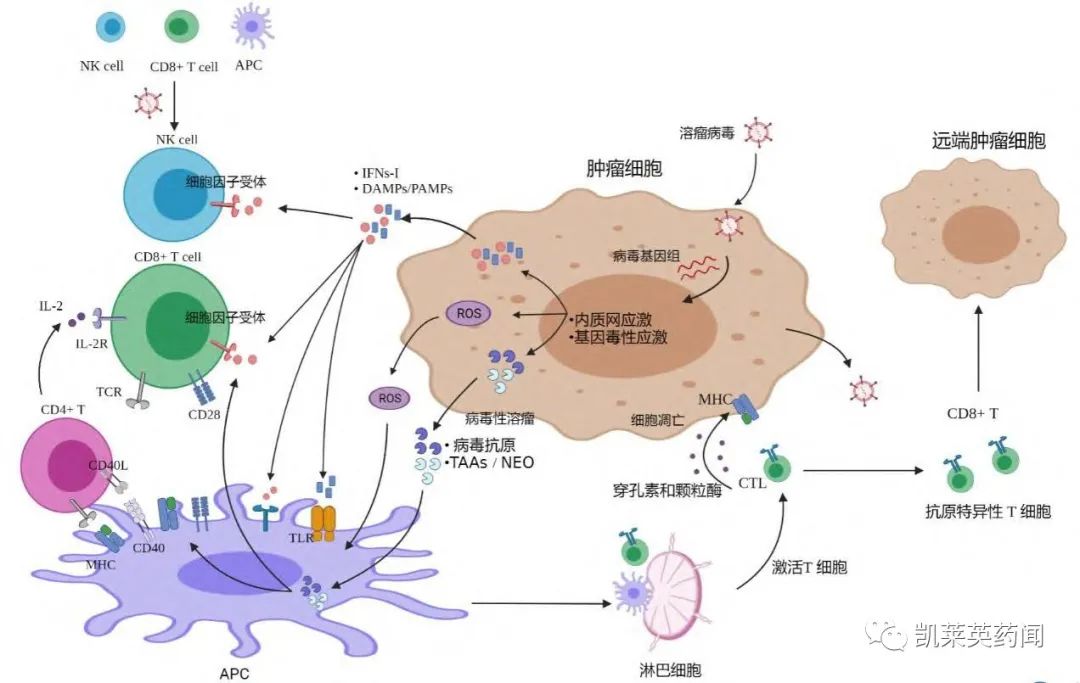

OVs refers to a kind of viruses that can selectively infect and kill tumor cells without damaging normal cells, and they often have good tumor lysis and targeting. OVs can replicate in the host cell after infecting tumor cells, and the released progeny viruses can continue to infect surrounding tumor cells, at the same time activate local or systemic anti-tumor immune effects, change tumor microenvironment and further improve anti-tumor effects. Natural oncolytic virus has some limitations, such as inconsistent safety or weak ability to stimulate the body to produce tumor immunity. In order to overcome the above shortcomings, oncolytic virus vector came into being: it not only retains the ability of oncolytic virus to kill tumor cells, but also enhances its efficacy of activating immune response after genetic modification.

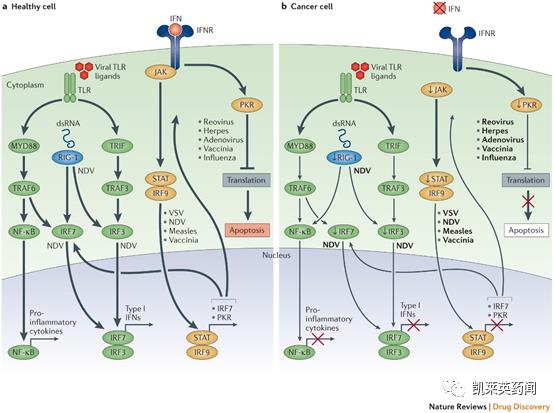

From non-gene editing type to gene editing type, OVs contains many kinds and characteristics. According to the different nucleotide types of virus genome, OVs vectors can be divided into DNA virus vectors and RNA virus vectors. Among them, the main DNA viruses are herpes simplex virus (HSV), adenovirus (AdV), vaccinia virus (VV) and H1(parvovirus H1. RNA viruses are mainly reovirus (RV), coxsackie virus (CV), poliovirus (PV), measles virus (MV), NDV and vesicular stomatitis virus (VSV).

The latest research progress

1. At present, five products have been approved for listing in the world, and it is predicted that they will reach the market of over 10 billion dollars in the future.

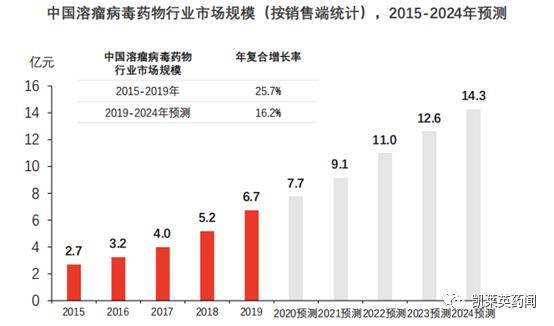

2. According to the data of Toubao Research Institute, the market size of oncolytic drugs in China will continue to grow at a compound annual growth rate of 16.2%, and it is expected to rise to 1.43 billion yuan by 2024.

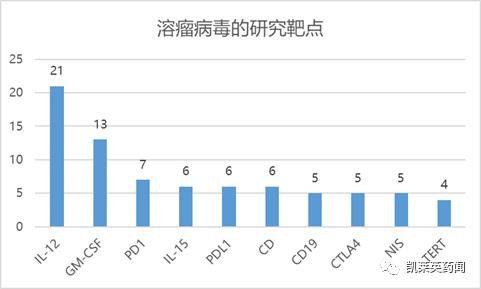

3. According to the number of research targets, they are IL-12, GM-CSF, PD1, IL-15, PDL1, CD, CD19, CTLA4, NIS, etc.

4. In the research enterprises, among them, there are many researches and developments on oncolytic viruses, such as Icell Kealex Therapeutics(10), Cell Genesys(7), Virogen Biotechnology (6), PsiOxusTherapeutics(5), Transgene(5) and Jennerex(4). In addition, domestic enterprises such as Innomicro, Synbiotics, Shanghai Medicine, Ruotai Medicine, Kangwanda Medicine, Saibainuo, Lepu Bio, Tasly, and Funuojian are also deployed in this field.

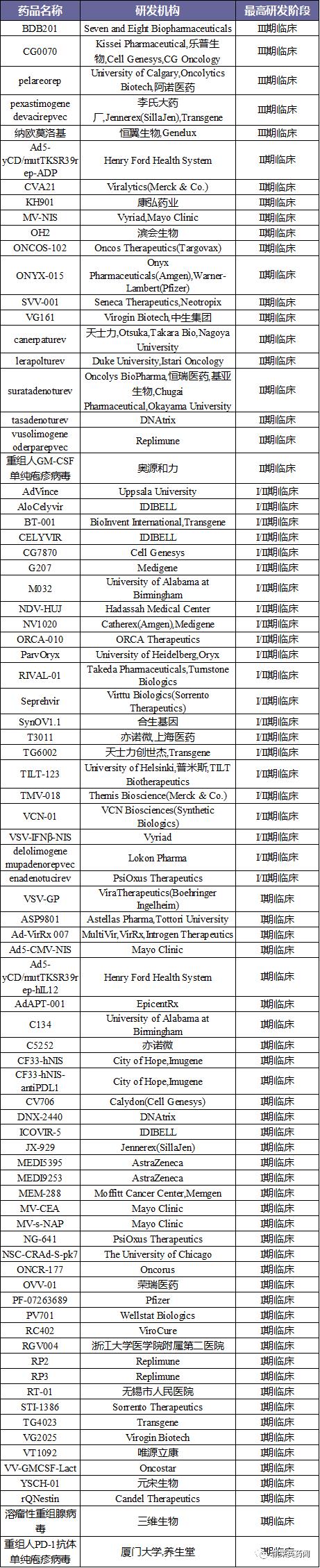

5. Statistics of drugs currently in clinical research stage are as follows:

two

Introduction of key drugs

Among the five oncolytic viruses approved worldwide, including picornavirus Rigvir, which is approved for the treatment of melanoma in Latvia; Secondly, today’s reborn (recombinant human P53 adenovirus injection) and recombinant human adenovirus type 5, which were approved in 2004 and 2005 respectively, were approved for the treatment of solid tumors such as hepatocellular carcinoma, nasopharyngeal carcinoma and pancreatic cancer. In 2015, the United States and Europe approved the engineered herpes simplex virus (HSV-1) of talimogene laherparepvec(T-VEC) for the treatment of unresectable metastatic melanoma. Finally, in 2021, Japan approved the improved herpes simplex virus teserpaturev for the treatment of brain cancers such as glioblastoma. The statistic of some drugs in that lead stage of clinical development are as follows:

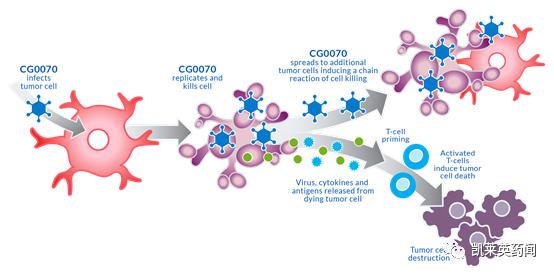

1、CG0070

CG0070 is a genetically modified adenovirus type 5 (Ad5), which contains cancer selective promoter E2F-1 and immune cell stimulating factor GM-CSF gene, and selectively replicates and lyses tumor cells in Rb-deficient tumor cells. The rupture of cancer cells will release tumor-derived antigen and GM-CSF expressed with the virus, thus stimulating systemic anti-tumor immune response. CG0070 was introduced by Lepu Bio from CG Oncology in the United States, and obtained its product development rights and global supply rights in China; Except China, the rights and interests in Japan, South Korea, China, Taiwan Province and other Asian countries were acquired by Kissei Pharmaceutical.

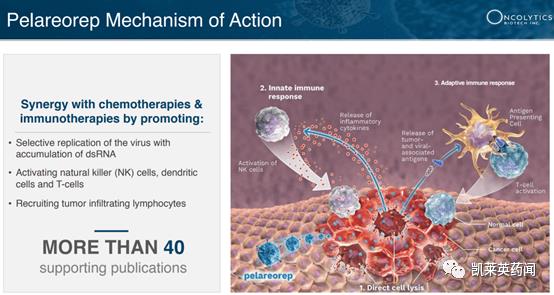

2、Pelareorep

Pelareorep(AN1004) is a non-pathogenic reovirus introduced by Oncologics Biotechnology by Arnold Pharmaceuticals. It can overcome the neutralizing antibody, selectively infect and destroy tumor cells by activating the body’s own immune system, and is used to treat various solid tumors and hematological malignancies. Pelareorep is a rapidly developed oncolytic virus product that can be administered by intravenous injection in the world. The second phase clinical trial of Pelareorep in the treatment of metastatic breast cancer found that the overall survival rate of patients with ER+PR+/HER2- breast cancer was doubled (21.8 months vs. 10.8 months). In its global phase II clinical trial (BERIL-1) for the treatment of head and neck squamous cell carcinoma (HNSCC), the median survival time of patients was as high as 10.4 months. In March, 2022, Oncologics Biotechnology announced that it had completed the safety assessment of three patients in the metastatic colorectal cancer (mCRC) cohort of the oncolytic virus Pelareorep phase 1/2 GOBLET study.

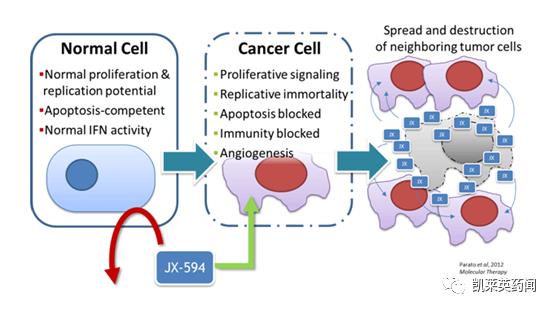

3、pexastimogene devacirepvec

Pexastimogen devacirepvec (JX-594) is a genetically engineered vaccinia virus introduced from abroad by Lee’s Pharmaceutical Factory. Its TK gene is mutated, and human GM-CSF gene is inserted to enhance the anti-tumor immune response. The advantages of using vaccinia virus include the stability of intravenous infusion, strong cytotoxicity and the safety of classical live vaccine. Previously, the drug had poor clinical performance in phase III of hepatocellular carcinoma, and the efficacy of the drug in combination with cemiplimab in the treatment of renal cell carcinoma is currently being evaluated.

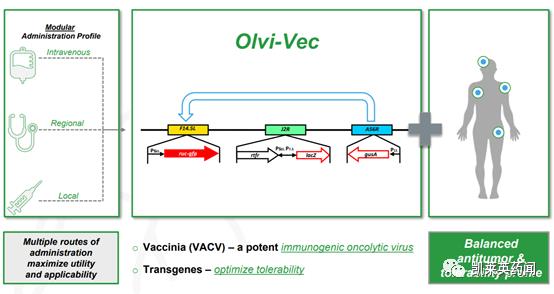

4. Naomi Loki

Loki (GL-ONC1, Olvi-Vec) was developed by Genelux Company, and Hengyi Bio owns its development rights in Chinese mainland. It is an oncolytic vaccinia virus. Three expression cassettes encoding β-galactosidase, β-glucuronidase and renin luciferase/green fluorescence (RLuc-GFP) fusion proteins are used to replace virus TK, hemagglutinin and F145L genes respectively. A phase I clinical trial of GL-ONC1 in patients with head and neck cancer showed that intravenous injection of GL-ONC1 combined with standard chemotherapy could improve the overall survival rate. This study also proved the safety of the virus.

5、OH2

OH2(BS001) is the first candidate drug for oncolytic virus in the world, which is independently developed by Binhui Ib/II-tech, and has chosen HSV2-2 as the carrier and entered clinical trials. Clinical data show that the objective remission rate (ORR), disease control rate (DCR) and one-year survival rate (OS) of BS001 are 30%, 50% and 50%, respectively. In addition, the latest clinical data in the treatment of colorectal cancer show that the objective remission rate of BS001 injection in the treatment of colorectal cancer patients has exceeded 10%. The objective remission rate of BS001 injection combined with PD-1 monoclonal antibody was 18.2%.

prospect

In recent years, with the development of genetic engineering technology, people have a deeper understanding of the function and structure of virus genes. Optimizing the design and operation of virus genome to produce non-pathogenic viruses has become the research direction of oncolytic viruses, which has greatly promoted the progress of oncolytic virus therapy. Combined treatment of oncolytic virus with chemotherapy or immunotherapy drugs, or even combined application of multiple oncolytic virus drugs, may control tumor progression or cure tumor more effectively, and provide potential clinical treatment options for tumor patients. We believe that with the deepening of oncolytic virus research, oncolytic virus therapy will play a wider and deeper role in treating human diseases.

references

Yang Hao, Zhang Shaogeng, Yang Penghui. Immunological mechanism and clinical research progress of oncolytic virus [J/OL]. Progress in biochemistry and biophysics: 1-16.

[2] Liu P, Wang Y, Wang Y, et al. Effects of oncolytic viruses andviral vectors on immunity in glioblastoma[J]. Gene therapy, 2020: 1-12.

[3] Kaufman H L, Kohlhapp F J, Zloza A. Oncolytic viruses: a newclass of immunotherapy drugs[J]. Nature reviews Drug discovery, 2015, 14(9):642-662.