A few days ago, the Federal Reserve made its 10th decision to raise interest rates in the past 14 months, which once again triggered market shocks. Continued interest rate hikes have not only brought the United States closer and closer to the economic recession, but also caused the whole world to take the blame for the United States.

Europe, which is the most tightly bound by American strategy, took the lead in responding, followed by the United States to raise interest rates passively for the seventh time since July last year.

△ Yahoo News reported that the European Central Bank held a monetary policy meeting on May 4 and decided to raise the three key interest rates in the euro zone by 25 basis points. The main refinancing rate, marginal lending rate and deposit mechanism rate were raised to 3.75%, 4.00% and 3.25% respectively from the 10th of this month.

However, the analysis believes that the monetary tightening policy has led to the continued weakness of the euro zone economy, and the European Central Bank will still be in a dilemma between curbing inflation and seeking economic growth.

△ US Consumer News and Business Channel website reports: According to Eurostat data, in the first quarter of this year, the GDP of the euro zone only increased by 0.1%, which was less than expected, and the German economy stagnated.

This dilemma is certainly not limited to Europe.

Due to the hegemony of the US dollar, the Fed’s aggressive interest rate hike this round made the yield of US bonds rise and the US dollar strengthened rapidly. Its spillover effect induced large-scale capital to flow to the United States, which made the stock markets, foreign exchange markets and bond markets of many countries suffer violent impacts, forcing these countries to follow the interest rate hike in order to maintain macroeconomic stability, thus increasing their own economic recession risks.

△ Most central banks in the world are raising interest rates at a synchronous rate that has not been seen in the past 50 years (screenshot of the US "Investment Encyclopedia" website report)

"Fed’s interest rate hike will aggravate the global debt crisis"

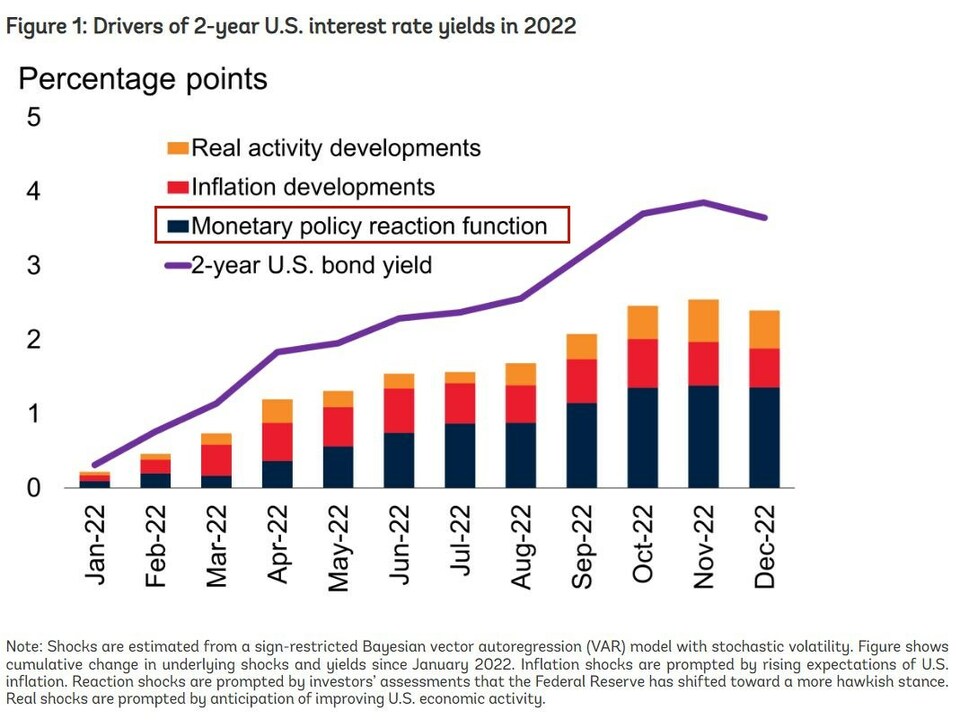

According to the analysis of experts from the World Bank, in the past year or so, the rise of interest rates in the United States was mainly driven by the "reaction shock" triggered by investors’ expectation of the Fed’s shift to a tougher monetary policy stance.

△ Screenshot of World Bank official blog report

The rise in US interest rates driven by "reaction shock" is particularly harmful to the financial markets of emerging markets and developing economies. Facts have proved that the sharp rise in interest rates in the United States and the corresponding rise in the foreign exchange value of the US dollar have had a significant spillover effect on the borrowing costs of emerging markets and developing economies. The debt levels of many emerging markets and developing economies have generally soared, and the debts of many governments have reached record highs. Some countries have fallen into financial difficulties and even defaulted on their debts.

△ The report "Debt Relief for Green and Inclusive Recovery (DRGR)" jointly released by the Center for Global Development Policy Research of Boston University, the Center for Sustainable Finance of the School of Asian and African Studies of London University and the Heinrich Burr Foundation in April shows that during 2008-2021, the sovereign debt of emerging markets and developing economies increased by 178%, from $1.4 trillion to $3.9 trillion.

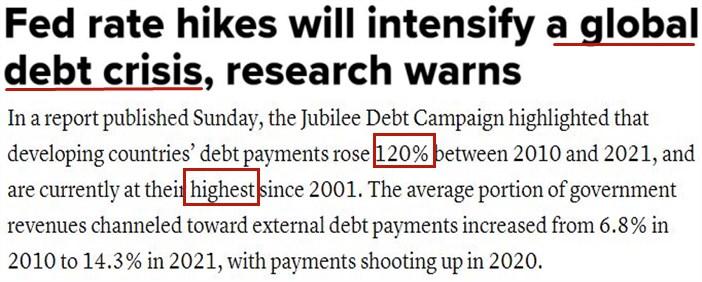

The US Consumer News and Business Channel also warned that the Fed’s interest rate hike will aggravate the global debt crisis. Debt payments in developing countries increased by 120% from 2010 to 2021, reaching the highest level since 2001. The average proportion of government revenue used to pay foreign debts increased from 6.8% in 2010 to 14.3% in 2021.

△ Screenshot of US Consumer News and Business Channel website report

Georgieva, managing director of the International Monetary Fund, warned that the Fed’s interest rate hike may "throw cold water" on the already weak recovery of some countries. The rising interest rate in the United States and the appreciation of the dollar may make it more expensive for countries to repay their debts denominated in dollars.

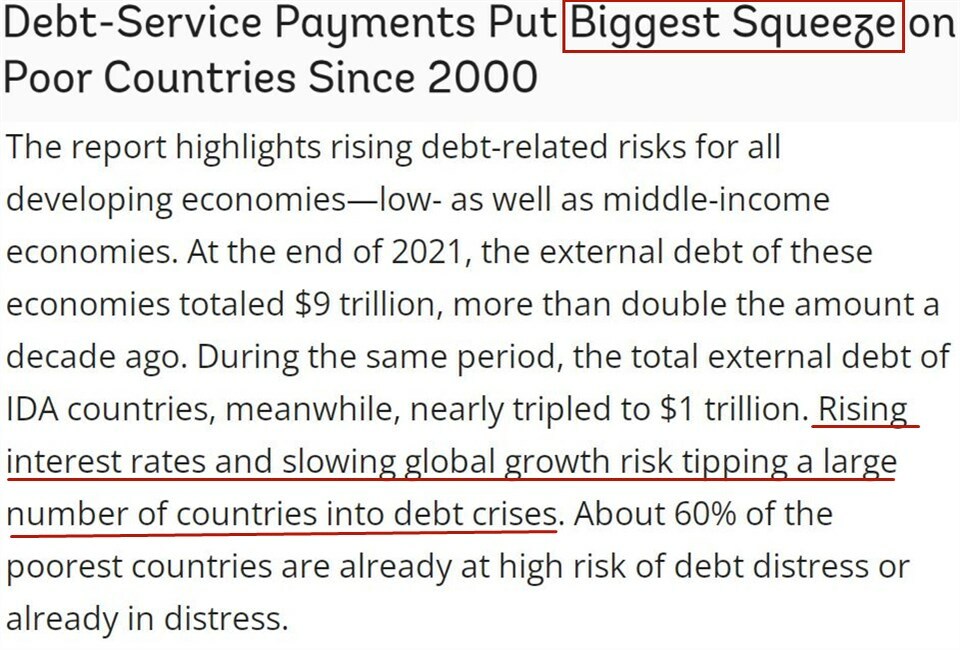

By the end of 2022, the total debt of developing countries rose to a record $98 trillion.

△ World Bank reports in official website: Rising interest rates and slowing global growth are likely to plunge a large number of countries into debt crisis. Debt servicing has brought the greatest pressure to poor countries since 2000.

"Casino capitalism" is accelerating the flight of many countries from the US dollar.

The history of dollar hegemony is the history of the United States arbitrarily harvesting world wealth.

The Australian "East Asia Forum" website once published an article pointing out that in the 1970s and early 1980s, the Federal Reserve led by Paul Volcker reduced the inflation rate in the United States by raising interest rates aggressively, but pushed up the global interest rate, causing many emerging economies to default on their debts. The debt crisis after the Volcker shock made developing countries feel sad. The Fed’s interest rate hike has had a devastating impact on Latin America. The gross domestic product (GDP) in this area plummeted, and the unemployment rate and poverty rate rose sharply. There are similar experiences in debt-ridden countries in Africa. The Fed has not paid enough attention to how its wayward policy choices will affect the rest of the world.

△ Australia’s "East Asia Forum" website report screenshot

This is true. How can the Fed, which holds the hegemony of the US dollar, care about other places? !

Eduardo Porter, an information columnist of Bloomberg, recently questioned: "Can the Fed led by Powell afford to ignore geopolitics?"

The article points out that today, the Fed once again faces the high inflation in the Volcker era. As it is raising interest rates at the fastest rate in more than 40 years, "the original memory of people’s disillusionment with economic prosperity is resurfacing throughout Latin America and the wider developing countries."

△ Screenshot of Eduardo Porter’s commentary reprinted on the Washington Post website.

In connection with the direct and indirect damage caused by the United States’ indiscriminate unilateral sanctions against other countries by using the hegemony of the US dollar for many years, the international community generally believes that the economic and financial policies of the United States have become the biggest challenge to global financial stability, economic recovery and common development.

Faced with the harm of dollar hegemony to the world economy, more and more economies have begun to take practical actions to safeguard their rights and interests. Many countries, including some American allies, have actively explored the path of "dollarization" by reducing US debt, promoting bilateral monetary agreements and diversifying foreign exchange reserve assets. In addition, central banks are still buying gold at the fastest rate since 1967.

△ Reuters reports: In 2022, central banks bought a record 1,136 tons of gold, and in 2023, the trend of global central banks’ gold purchase continued.

With the acceleration of the global "dollarization" process, the control of the US dollar as the world’s reserve currency on the international economic system is weakening. The data shows that in the past 20 years, the share of the US dollar in the international reserves of global central banks has dropped by 12 percentage points, from 71% to 58.36% in 2022, which is the lowest level since the data was recorded in 1995.

△ Screenshot of Turkish Radio and Television Corporation (TRT) website report

Peter Earle, an economist at the American Economic Research Institute, recently pointed out in his article "De-dollarization has begun" that the US dollar has gradually changed from an ordinary carrier of payment, settlement and investment to a financial tool used by the US government to implement unilateral sanctions. Especially after the escalation of the Ukrainian crisis last year, the US wantonly weaponized the US dollar, which accelerated the flight of many countries. "In the long run, ‘ De-dollarization ’ Will continue, and the dollar will lose power overseas sooner or later. "

△ Screenshot of the article on the website of the American Economic Research Institute

Pepe Escobar, a Brazilian geopolitical analyst and senior journalist, called American monetary policy "casino capitalism" in an interview with the media. He pointed out that after weighing the pros and cons, more and more countries found that the US dollar was not safe. The aggressive U.S. sanctions policy and reckless government spending have significantly reduced the international appeal of the dollar. The upcoming BRICS summit in South Africa may be the key to progress in dollarization. The dollar-centered world order is doomed to end.

△ Sputnik news agency & radio report screenshot

Source: Global Information Broadcasting "Global Deep Observation"

Planning Wang Jian

Reporter Shan Lijuan

Editor Yang Nan

Qian Shen Zou Haoyu

Producer: Jiang Aimin