Statistical Bulletin of National Economic and Social Development of Guangzhou in 2009 Guangzhou Municipal Bureau of Statistics Guangzhou Investigation Team of National Bureau of Statistics (March 29, 2010) In 2009, faced with the severe impact and impact of the international financial crisis, the people of the whole city, under the strong leadership of the Municipal Party Committee and the Municipal Government, resolutely implemented the national macro-control policies, earnestly practiced Scientific Outlook on Development, and actively sought countermeasures. Focusing on the central government’s central task of "maintaining steady and rapid economic development" and the province’s "three promotion and one maintenance", we worked hard to overcome all kinds of difficulties. The city’s economy developed steadily and rapidly, all social undertakings made all-round progress, and people’s lives continued to improve, and the economic and social development goals and tasks for the whole year were well completed. I. Comprehensive Economic Aggregate The city’s economy has developed steadily and rapidly. In 2009, Guangzhou achieved a regional GDP of 911.276 billion yuan, an increase of 11.5% over the previous year (the same below) at comparable prices. Among them, the added value of the primary industry was 17.255 billion yuan, an increase of 3.9%; The added value of the secondary industry was 339.465 billion yuan, an increase of 8.8%; The added value of the tertiary industry was 554.556 billion yuan, an increase of 13.6%. The ratio of added value of primary, secondary and tertiary industries is 1.9∶37.2∶60.9. The contribution rates of the three industries to economic growth are 0.6%, 29.3% and 70.1% respectively. Fiscal revenue and expenditure grew steadily. The annual general budget revenue from Guangzhou was 265.6 billion yuan, an increase of 7.2%. Among them,The revenue of the national tax department was 160.7 billion yuan, an increase of 7.5%; The revenue of the local tax department was 75.4 billion yuan, an increase of 3.7%. The local general budget revenue was 70.258 billion yuan, an increase of 13.0%. Among them, the business tax was 15.16 billion yuan, an increase of 18.5%; The value-added tax was 13.751 billion yuan, an increase of 6.8%; Enterprise income tax was 7.323 billion yuan, down 3.2%; Personal income tax was 3.898 billion yuan, an increase of 10.3%; Property tax was 3.496 billion yuan, up by 12.6%. The fiscal expenditure of the local general budget was 79.026 billion yuan, up by 10.8%. Among them, social security and employment expenditure was 10.205 billion yuan, up by 14.3%; Expenditure on environmental protection was 857 million yuan, an increase of 15.8%; Expenditure on education was 10.991 billion yuan, up by 14.8%. Price grid consumer market price: consumer prices run at a low level. The overall level of consumer prices of urban residents dropped by 2.5% in the whole year, of which the price of consumer goods dropped by 2.3% and the price of service items dropped by 2.9%.Table 1: urban consumer price index, Guangzhou in 2009:% category and above, the annual price is 100, the total consumer price index of urban residents is 97.5, the price index of consumer goods is 97.7, the price index of service items is 97.1, classified by category: food is 99.3, of which: grain is 106.7, meat and poultry and their products are 93.2, aquatic products are 100.5, vegetables are 97.5, tobacco, alcohol and supplies are 102.8, clothing is 94.6, household equipment supplies and maintenance clothes. 97.5 Among them: durable consumer goods 97.3 medical care and personal goods 100.2 transportation and communication 96.2 entertainment, education, cultural goods and services 97.1 residence 95.3 production price: production price continues to decline. The ex-factory price of industrial products decreased by 3.5% in the whole year. Among them, the prices of means of production decreased by 5.4% and the prices of means of subsistence decreased by 1.3%. The purchase prices of raw materials, fuel and power decreased by 8.2%. Among them, the purchase prices of ferrous metal materials, steel products and chemical raw materials decreased by 11.3%, 13.7% and 9.9% respectively. Investment in fixed assets: the investment in fixed assets in the whole society has grown rapidly. In the whole year, the investment in fixed assets of the whole society was 265.985 billion yuan, an increase of 22.3%; Fixed assets increased by 156.419 billion yuan, an increase of 23.1%. The investment in capital construction was 129.026 billion yuan, an increase of 27.7%; The investment in renovation was 54.172 billion yuan, an increase of 40.4%; The investment in real estate development was 81.734 billion yuan,An increase of 7.1%. Municipal units (including districts, county-level cities and others) completed an investment of 213.873 billion yuan, accounting for 80.4%; Central and provincial units have invested 52.112 billion yuan, accounting for 19.6%. From the perspective of industrial investment, the primary industry completed an investment of 349 million yuan, an increase of 1.1 times. The investment in the secondary industry was 54.532 billion yuan, an increase of 18.0%; Among them, the industrial investment was 53.761 billion yuan, up by 20.4%, and the industrial renovation investment was 15.575 billion yuan, up by 3.5%. The tertiary industry completed an investment of 211.104 billion yuan, an increase of 23.4%. The proportion of investment in the three industries is 0.13∶20.50∶79.37. Two, the main industries, agriculture, forestry, animal husbandry and fishery and its service industry, agricultural production developed steadily. The total output value of agriculture, forestry, animal husbandry and fishery was 29.566 billion yuan, an increase of 4.2%. Among them, the output values of agriculture, forestry, animal husbandry, fishery and agriculture, forestry, animal husbandry and fishery services were 14.975 billion yuan, 208 million yuan, 6.316 billion yuan, 5.309 billion yuan and 2.758 billion yuan respectively. The output value of agricultural commodities was 26.816 billion yuan, up by 1.6%. The production and marketing rate of agricultural products is 90.7%. The structural adjustment of agricultural products was accelerated. The annual grain planting area was 1.351 million mu, an increase of 0.7 million mu; The vegetable planting area was 2.055 million mu, an increase of 0.1 million mu; The planting area of flowers is 212,000 mu, an increase of 4.3%; At the end of the year, the fruit planting area was 990,000 mu, an increase of 2,000 mu.The ecological benefits of forestry are remarkable. The total stock of forest standing trees in the city is 11.281 million cubic meters, the forest coverage rate is 38.2%, and the greening rate of trees is 44.8%. Table 2: Output of main agricultural, animal husbandry and fishery products and their growth rate in 2009 The unit output of product name measurement increased or decreased (%) compared with the previous year. Ten thousand tons of grain, food, vegetables and vegetables were 317.51.1 million tons of fruit, 42.32.1 million tons of sugar cane, 49.62.4 million pigs, 225.24.6 million domestic birds and 1.24.5 tons of water. Agriculture The total income of urban agriculture in the whole year was 135 billion yuan, an increase of 2.6%. The total output value of urban agriculture was 102.6 billion yuan, up by 4.5%. Among them, the output value of processing local agricultural products was 73 billion yuan, an increase of 5%. The output value of characteristic agriculture and high-tech agricultural products, which reflect the level of urban agricultural production, reached 250 million yuan and 3.9 billion yuan respectively, up by 12.5% and 2.5% respectively. There are 80 leading agricultural enterprises above the municipal level, including 5 national leading enterprises, 19 provincial leading enterprises and 30 urban agricultural demonstration zones. The output value of agricultural industrialization was 7 billion yuan, an increase of 4%; The scale of agricultural industrialization reached 23.6%. The growth rate of industrial production rebounded. The annual industrial added value was 310.684 billion yuan,It accounts for 34.1% of the city’s GDP, an increase of 9.0%, and its contribution rate to the city’s economic growth is 27.7%. The total industrial output value for the whole year was 1,348.078 billion yuan, an increase of 9.9%; Among them, the total output value of industrial enterprises above designated size reached 1,250.208 billion yuan, an increase of 10.2%. The output value of the city’s industrial export products was 234.437 billion yuan, up by 3.3%. The sales rate of industrial products in the city was 98.45%, up by 0.5 percentage points. Table 3: Main categories of Guangzhou’s total industrial output value in 2009 Unit: The absolute number of 100 million yuan index increased or decreased (%) compared with the previous year. The total industrial output value was 13480.789.9, of which: state-owned and state-controlled enterprises were 4541.302.0, of which: collective enterprises were 74.891.1, joint-stock enterprises were 3178.458.0, and joint-stock cooperative enterprises were 38.888. 7 Foreign-funded enterprises from Hong Kong, Macao and Taiwan 7556.9813.8, in which: private enterprises 2765.6612.9, in which: light industry 4685.819.6, heavy industry 8794.9710.4 Table 4: In 2009, the unit output of major industrial products of industrial enterprises above designated size in Guangzhou increased or decreased (%) compared with the previous year.10,000 tons of soft drinks, 4,718,862.2 tons of beer, 97.98-76 million pieces of clothing, 618.18 million kilowatt hours, 381.69-9.0 tons of synthetic detergent, 173.289.8 tons of tires, 1215.5715.0 tons of finished steel, 7,029.25 million cars, 113.026 million cars. 4.6 Ten thousand room air conditioners, 462.76-65,000 fax machines, 789.10.6 microcomputers, 221.216.1 color televisions, 203.2913.7 elevators, 2977.4 pianos, 9725.0 Note: The statistical caliber of industrial enterprises above designated size refers to industrial legal persons whose annual main business income is 5 million yuan or more. Three pillar industries: The three pillar industries grew rapidly. The total industrial output value of the three pillar industries above designated size, namely automobile manufacturing, electronic product manufacturing and petrochemical manufacturing, was 524.309 billion yuan, up by 20.3%, accounting for 41.94% of the total industrial output value of the whole city. Among them, the total industrial output value of the automobile manufacturing industry was 228.06 billion yuan, an increase of 30.4%, accounting for 18.24% of the total industrial output value above designated size in the city. The automobile parts manufacturing industry increased by 29.6%.The total industrial output value of electronic products manufacturing industry and petrochemical manufacturing industry reached 133.406 billion yuan and 162.843 billion yuan respectively, increasing by 32.1% and 1.7% respectively. Industrial economic benefits: the main business income of industrial enterprises above designated size in the city was 1,225.69 billion yuan, an increase of 6.1%; The total profit and tax was 136.932 billion yuan, an increase of 18.0%; The total profit was 73.971 billion yuan, an increase of 22.4%. The loss of loss-making enterprises decreased by 33.1%; The loss of enterprises was 22.3%, a decrease of 1.6 percentage points. The construction industry’s production growth rate is stable. The total output value of construction enterprises above the qualification level (excluding labor subcontracting, the same below) was 100.835 billion yuan, an increase of 15.2%; The completed output value was 64.517 billion yuan, an increase of 27.6%. The building construction area was 62,021,900 square meters, up by 0.7%; The completed housing area was 14,737,600 square meters, down by 14.3%. According to the total output value of the construction industry, the labor productivity of all construction workers reached 291,600 yuan/person, an increase of 30,800 yuan/person. Construction enterprises with above qualifications have set foot in 30 provinces and cities throughout the year, and the total construction output value completed in other provinces is 23.005 billion yuan, an increase of 36.2%, accounting for 22.8% of the total construction output value of the city with above qualifications. Transportation, warehousing, postal services, the added value of transportation, warehousing and postal services in the whole year was 78.494 billion yuan, an increase of 8.0%.Table 5: In 2009, the unit absolute number of passenger and cargo traffic in Guangzhou increased or decreased (%) compared with the previous year. The passenger turnover was 5705089.3.0 The passenger turnover was 145283.56 million tons, the cargo turnover was 52516.04.5.9 million tons, 2184.91 -11.3 Urban ports: Port transportation grew steadily. The number of take-off and landing flights of Guangzhou Baiyun International Airport reached 308,700, an increase of 10.2%. Guangzhou Baiyun International Airport has a passenger throughput of 37,046,900 passengers and an airport cargo and mail throughput of 1,221,900 tons, up by 10.8% and 31.3% respectively. The annual port cargo throughput was 375.6072 million tons, an increase of 1.6%; Among them, the cargo throughput of Guangzhou Port was 363.8608 million tons, an increase of 4.9%. The port container throughput was 11.302 million TEUs, down 3.6%. Postal service and telecommunications industry: The postal service and telecommunications industry have developed steadily. In 2001, the postal revenue was 1.65 billion yuan, an increase of 7.7%. 217 million letters were received and sent, down by 6.9%; The number of express mail items was 19.9439 million, an increase of 23.3%. In 2001, the revenue from telecommunication business was 25.536 billion yuan, up by 1.7%. At the end of the year, the number of fixed telephone users in the city was 6,333,100, down 2.8% from the end of the previous year. There were 20,994,400 mobile phone users, an increase of 6.5%.There were 2,801,900 Internet users, an increase of 19.0%. Domestic business and domestic market are active. The total retail sales of social consumer goods reached 364.776 billion yuan, an increase of 16.2%. The total sales of wholesale and retail commodities in the whole year was 1,517.359 billion yuan, an increase of 13.0%. Wholesale and retail: Wholesale and retail grew rapidly. In the whole year, the added value of wholesale and retail industry reached 105.376 billion yuan, an increase of 16.7%. The retail sales reached 303.787 billion yuan, an increase of 15.8%. Among them, the retail sales of wholesale and retail enterprises above designated size reached 138.814 billion yuan, an increase of 12.0%, accounting for 45.7% of the retail sales of wholesale and retail in the city. In the classification of goods sold by wholesale and retail enterprises above designated size, the retail sales of Chinese and western medicines increased by 29.4%, automobiles by 19.8%, daily necessities by 16.6%, clothing, shoes and hats, knitwear by 13.3%, and gold, silver and jewelry by 11.1%. Accommodation and catering industry: Accommodation and catering industry continued to grow. In the whole year, the added value of accommodation and catering industry reached 28.297 billion yuan, an increase of 14.5%. The retail sales of accommodation and catering industry reached 60.989 billion yuan, an increase of 18.3%. Among them, the retail sales of star-rated accommodation industry and catering enterprises above designated size reached 17.516 billion yuan, an increase of 9.6%. Financial industry finance: the scale of deposits and loans of financial institutions has been further expanded.In the whole year, the added value of the financial industry reached 55.332 billion yuan, an increase of 29.0%. At the end of the year, the balance of local and foreign currency deposits of financial institutions in the city was 2,094.419 billion yuan, an increase of 401.095 billion yuan that year. The balance of local and foreign currency loans was 1,385.183 billion yuan, an increase of 284.764 billion yuan that year. Table 6: Deposits and loans of Chinese and foreign-funded financial institutions in Guangzhou in 2009 refers to the increase or decrease (%) of RMB deposits in the year ending compared with the beginning of the year (100 million yuan) 20401.72 3976.8924.2, of which: enterprise deposits 8092.17 1647.4325.6 savings deposits 7954.22 1086.8715.8 RMB loans. 8.16 2373.9623.2, in which: short-term loans 3094.11 379.6314.0 medium-and long-term loans 8854.24 2181.2532.7 Balance of foreign currency deposits (USD 100 million) 79.45 5.066.8 Balance of foreign currency loans (USD 100 million) 183.60 69.48 Securities: capital. At the end of the year, there were 3 securities companies in the city; There are 134 securities business departments. There are 38 listed companies in the domestic securities market in the city, including 3 newly issued stocks in China. In the whole year, 11 companies raised funds through the domestic securities market, with a financing amount of 15.558 billion yuan. Insurance: The insurance industry has developed rapidly. At the end of the year,There are 147 insurance intermediaries in the city, including 107 insurance agencies, 15 insurance brokerage companies and 25 insurance assessment companies. The annual premium income was 32.599 billion yuan, up by 5.4%. Among them, property insurance premium income was 8.476 billion yuan, an increase of 14.5%; Personal insurance premium income was 24.123 billion yuan, an increase of 2.5%. All kinds of insurance claims were paid and 7.951 billion yuan was paid, up by 19.0%. Among them, property insurance was 4.671 billion yuan, an increase of 22.6%; Personal insurance was 3.28 billion yuan, an increase of 14.3%. Real estate investment in real estate development has steadily increased. The real estate industry realized an added value of 70.579 billion yuan, an increase of 20.5%. The real estate development industry completed an investment of 81.734 billion yuan, an increase of 7.1%. The building construction area was 55,055,600 square meters, down by 0.7%. The completed housing area was 9,612,400 square meters, down 9.1%. The sales area of commercial housing (including affordable housing) was 13.7542 million square meters, an increase of 34.2%. The sales price of houses showed a trend of low before and then high. It stopped falling and rebounded from August, and rose rapidly in the fourth quarter. In December, it rose by 8.7% compared with the same month of the previous year, among which the newly-built commercial houses rose by 19.9%. Other service industries realized an added value of 216.478 billion yuan, accounting for 23.8% of the city’s regional GDP, an increase of 8.7% over the previous year;Among them, the annual added value of modern service industries such as business services, telecommunications, education, health and professional technical services all exceeded 10 billion yuan. III. Urban Construction and Management Infrastructure Construction The construction of modern urban infrastructure, which is hub-type, functional and networked, has been accelerated, and the carrying capacity of economic and social development has been enhanced. In the whole year, the urban areas (ten districts) completed urban construction with fixed assets investment of 42.42 billion yuan. At the end of the year, the total length of urban roads in urban areas (ten districts) reached 5497 kilometers, an increase of 1.2%; The total area of urban roads was 95.02 million square meters, an increase of 2.1%. During the year, the city’s subway mileage reached 147 kilometers. The comprehensive service level of public utilities has been continuously improved. The annual tap water sales volume was 1.529 billion cubic meters (10-zone caliber); The domestic water consumption is 1.151 billion cubic meters. By the end of the year, the total sales volume of urban gas was 1,561.06 million cubic meters (including liquefied gas, artificial gas and natural gas, in which liquefied gas and artificial gas were converted into natural gas calorific value), an increase of 11.8%. Environmental protection and governance The work of environmental protection and governance has been further strengthened. At the end of the year, there were 9 automatic ambient air monitoring stations in the city. In the whole year, there were 126 days when the urban air pollution index in Guangzhou was Grade I and 221 days when it was Grade II, accounting for 95.07% of the total number of days in the whole year, an increase of 0.81 percentage points over the previous year. The annual average concentration of inhalable particulate matter in urban areas is 0.070 mg/m3, which is 1.4% lower than the previous year.The annual average concentration of sulfur dioxide is 0.039 mg/m3, down by 15.2%; The annual average concentration of nitrogen dioxide is 0.056 mg/m3, which is the same as that of the previous year. The average equivalent sound level of environmental noise in urban areas is 55 decibels, which is the same as last year. The average equivalent sound level of urban traffic trunk lines is 69.2 decibels, up by 0.1 decibels. The water quality of Guangzhou reach of the Pearl River belongs to Class IV, reaching Class III standard in the wet season. Compared with 2008, the water quality of rivers in the city remained stable, and the activities of crossing the Pearl River were successfully held for four consecutive years. According to the index weight method, the water quality compliance rate of centralized drinking water sources is 98.82%, up by 0.02 percentage points over the previous year. According to the "one-vote veto method", the water quality compliance rate of centralized drinking water sources is 82.23%. An increase of 1.27 percentage points over the previous year. Social security: Vigorously strengthen the comprehensive management of social security. In the whole year, the number of criminal cases filed in the city was 59,900, down by 12.8%, and the cases of "two robberies" fell by 22.5%; The number of criminal cases solved in that year was 29,800, and the detection rate increased by 5.3 percentage points. There were 4,261 traffic accidents in the whole year, with 1,131 traffic accident deaths and a loss of 13,396,500 yuan, down by 21.4%, 8.8% and 20.6% respectively. There were 1202 fires in the whole year, resulting in 17 deaths and a loss of 12,758,200 yuan, down by 0.7%, flat and 2.6% respectively.IV. Adjustment of ownership structure and opening to the outside world All kinds of ownership economies have developed in an all-round way. Among the city’s regional GDP, the added value of the public sector of the economy was 449.993 billion yuan, an increase of 11.1%; The added value of the non-public sector of the economy was 461.283 billion yuan, up by 12.0%, accounting for 50.6% of the city’s regional GDP from 50.4% in the previous year. Among them, the added value of private economy was 316.444 billion yuan, an increase of 12.5%, accounting for 34.73% of the city’s regional GDP. Among the total industrial output value above designated size in the city, the total industrial output value of state-owned and state-controlled industrial enterprises was 454.130 billion yuan, an increase of 2.0%, accounting for 3.632% of the total industrial output value above designated size in the city; The total output value of industrial enterprises invested by foreign businessmen and businessmen from Hong Kong, Macao and Taiwan was 750.90 billion yuan, up by 13.8%, accounting for 60.06% of the total output value of industrial enterprises above designated size in the city. The total output value of joint-stock industrial enterprises was 291.364 billion yuan, an increase of 7.7%, accounting for 23.31%; The total output value of joint-stock cooperative industrial enterprises was 2.283 billion yuan, an increase of 7.4%, accounting for 0.18%. The total import and export volume of foreign trade was 76.737 billion US dollars, down 6.4%. Among them, the total export value of commodities was 37.405 billion US dollars, down by 13.0%; The total import volume of commodities was US$ 39.332 billion, up by 0.8%. The export of foreign investors and investment enterprises from Hong Kong, Macao and Taiwan reached 22.45 billion US dollars, down by 11.6%.Accounting for 60.0% of the city’s total commodity export value; State-owned enterprises exported $7.603 billion, down by 17.5%; Collective enterprises exported 465 million US dollars, down by 22.5%; The export of private enterprises was 6.757 billion US dollars, down by 12.0%. Table 7: Main categories of commodity import and export in 2009 Unit: The absolute number of billion US dollars increased or decreased (%) compared with the previous year. The total export volume of commodities was 767.37-6.4, 374.05-13.0, of which: general trade 160.28-16.4, processing trade 199.16-10.4, of which: mechanical and electrical products 200.10-11.4. The import value of high-tech products 76.021.7 is 393.320.8, of which: general trade 239.6419.9, processing trade 123.03-9.9, of which: mechanical and electrical products 163.793.2, high-tech products 83.266.9, and the actual utilization of foreign capital by foreign direct investment increased. The actual use of foreign direct investment in the whole year was 3.773 billion US dollars, an increase of 4.2%; 844 foreign direct investment projects (enterprises) were approved, down by 14.8%; The contracted foreign direct investment amounted to US$ 3.784 billion, down by 36.1%. In the whole year, 145 foreign investment projects with a total investment of more than 10 million US dollars were approved, with a contractual foreign investment of 3.757 billion US dollars.Decreased by 25.0%. In 2009, Guangzhou absorbed 844 foreign direct investment projects from 56 countries and regions. By the end of 2009, 170 of the world’s top 500 enterprises had entered Guangzhou, and 394 projects were set up with a total investment of 16.16 billion US dollars. At the end of the year, there were 9,250 foreign direct investment enterprises registered in Guangzhou Administration for Industry and Commerce, an increase of 0.1% over the end of last year. Foreign-invested enterprises set up 5916 branches (unincorporated) in Guangzhou, and foreign, Hong Kong, Macao and Taiwan enterprises set up 4019 permanent representative offices in Guangzhou. Table 8: Foreign Direct Investment by Sector and Its Growth Rate in Guangzhou in 2009; Name of Industry; Increase or decrease of contracted foreign capital (USD 10,000) compared with the previous year (%); increase or decrease of actually used foreign capital (USD 10,000) compared with the previous year (%). Total 378401-36.13773394.2 Agriculture, forestry, animal husbandry and fishery 1001-37.5796833.2 times of mining ………………………………………………………………………………………………………… The production and supply of gas and water is 81012.9153661.1 times that of the construction industry, 438-46.7265949.8 times that of the transportation, storage and postal industry, 23901-44.62591.6 times that of information transmission, Computer service and software industry 10511-67.98395-11.9 Wholesale and retail industry 12812.23037.8 Accommodation and catering industry-203 … 44452.3 Finance industry 50004 times 29517.2 times real estate industry 3066-79.440-36.0 Leasing and business service industry.5007.000000000806 Research, technical services and geological exploration industry 731183.029116.1 times water conservancy, environment and public facilities management industry 834-79.7247469.6 Residents service and other service industries 30-99.1240429.8 times education 2-94.96224.0 Health, social security and social welfare industry 132 …The pace of contracting projects, labor cooperation and overseas investment enterprises to "go global" has accelerated. In 2001, the turnover of foreign contracted projects and foreign labor cooperation was 388 million US dollars, an increase of 21.2%. The newly signed contracts for foreign contracted projects and foreign labor cooperation amounted to US$ 405 million, an increase of 33.5%. By the end of the year, 11 countries and regions were involved in Guangzhou’s foreign contracted projects and foreign labor cooperation. In the whole year, 74 overseas enterprises were added, and the Chinese side invested 418 million US dollars. The tourism industry is growing well. The total revenue of tourism in the whole year was 99.404 billion yuan, an increase of 18.7%. Among them, tourism foreign exchange income was 3.624 billion US dollars, up by 15.8%; Domestic tourism revenue was 74.652 billion yuan, an increase of 20.4%. The accommodation industry received 28.7941 million overnight visitors, an increase of 7.5%. Among them, there were 24,709,600 domestic tourists, an increase of 8.0%; The number of overseas tourists was 4.0845 million, an increase of 4.7%. The occupancy rate of major hotels is 58.9%. The number of tourists organized by travel agencies was 7,692,000, an increase of 3.6%. The main tourist attractions received 92.3929 million tourists, an increase of 64.1%. V. Science and technology and social undertakings Science and technology adhere to the strategy of rejuvenating the city through science and education, and the ability of scientific and technological innovation has been continuously enhanced. In 2001, 16,530 patent applications were accepted, an increase of 18.2%; Among them, there were 5042 invention patents, an increase of 24.6%, accounting for 30.5% of the applications. 11,095 patents were granted,An increase of 37.3%; Among them, 1,516 invention patents were granted, an increase of 35.1%. Scientific research institutions and teams are stable. At the end of the year, there were 16 academicians of China Academy of Sciences and 18 academicians of China Academy of Engineering. The city has 162 national, provincial and municipal engineering technology research centers; Among them, there are 12 national, 59 provincial and 91 municipal. There are 160 independent research and development institutions. There are 7 national and provincial university science parks. According to the new identification method, 359 high-tech enterprises in our city passed. The annual output value of industrial high-tech products was 410.385 billion yuan, an increase of 17.3%, accounting for 32.8% of the total industrial output value. The development of higher education was accelerated. At the end of the year, there were 76 colleges and universities in the city. In the whole year, 254,800 undergraduate and junior college students were enrolled; There are 796,000 students in school; There are 187,800 graduates. By the end of the year, there were 26 universities and scientific research institutions that trained graduate students in the city. Recruited 22,200 graduate students throughout the year; There are 60,100 graduate students in school; There are 15,300 graduate students. Basic education has been solidly promoted and educational reform has been deepened. 100% of the districts, county-level cities and 100% of the towns in the city have achieved the title of "Strong Education Area in Guangdong Province" and "Strong Education Town in Guangdong Province", and the Guangdong Provincial People’s Government has awarded Guangzhou the title of "Strong Education City in Guangdong Province". The first batch of 25 demonstration ordinary high schools in our city all passed the final supervision and acceptance organized by the Provincial Department of Education, and were named as "Guangdong National Demonstration Ordinary High Schools".. Students in ordinary high schools at provincial and municipal levels account for 90.10% (excellent degree) of students in ordinary high schools in the city. By the end of the year, there were 1,022 primary schools in the city with 828,900 students. There are 471 ordinary middle schools with 575,300 students; Among them, there are 174,400 students in ordinary high schools. There are 94 secondary vocational schools with 251,100 students. There are 84 technical schools with 242,000 students. The enrollment rate of school-age children in the city is 100%, the enrollment rate of junior high school graduates is 90.76%, and the enrollment rate of ordinary high school graduates is 85.43%. Actively develop diversified schools and continue to develop private education. At the end of the year, there were 29 private colleges and universities in the city with 229,000 students. 157 private ordinary middle schools with 95,200 students; There are 158 private primary schools with 245,800 students. New achievements have been made in cultural culture, journalism, publishing and radio, film and television. Successfully held the 7th China Music Golden Bell Award, 14th Guangzhou International Art Fair, 2009 China (Guangzhou) International Documentary Conference and other large-scale cultural exchange activities. In international and national professional literary awards, Guangzhou has won 63 awards. At the end of the year, there were 15 professional art performance groups in the city; There are 14 cultural centers and 164 cultural stations. 15 public libraries; The library has a total collection of 16,859,600 volumes. There are 28 archives, 31 museums and memorial halls, and 398 exhibitions.The number of visitors was 7.239 million. Four films were produced throughout the year. There are 2 radio stations and 3 TV stations in the city. The level of health care infrastructure has been improved. At the end of the year, there were 2341 health institutions of various types in the city (excluding 1079 village clinics); Among them, there are 224 hospitals, 19 centers for disease control and prevention, 15 health supervision institutes and 14 maternal and child health centers (institutes). Various health institutions in the city have a total of 59,100 beds; Among them, the hospital has 50,500 beds. There are 89,200 professional health technicians in the city; Among them, there are 32,900 medical practitioners (including assistant medical practitioners) and 35,100 registered nurses. All kinds of medical and health institutions in the city provided 101.87 million medical services to the society and 1.61 million discharge services, up by 10.9% and 11.8% respectively. The health level of residents has improved steadily. In the whole year, according to the statistics of resident population, the maternal mortality rate and infant mortality rate were 17.85/100,000 and 3.98‰ respectively. The network direct reporting system of infectious diseases in the city has been improved, and the emergency response capability of public health emergencies has been continuously enhanced, and 108 public health-related incidents have been handled in time. Rural health and urban community health services have been improved. The participation rate of farmers who participated in the new rural cooperative medical system reached 99.7% in the whole year, and 200,000 farmers who participated in the new rural cooperative medical system received a total of 324 million yuan of reimbursement compensation for the cooperative medical system. Among them, the number of hospitalization compensation reached 147,400, and the hospitalization compensation was 2,137 yuan/person.The amount of hospitalization compensation accounts for 34.7% of the total hospitalization expenses. Another 2,800 people received hospitalization medical assistance from the Cooperative Medical Security Assistance Fund, with an amount of 5.88 million yuan. By the end of the year, 128 community health service centers and 116 community health service stations had been built in the city, covering more than 97% of the streets in the city, and 92% of the community health service institutions in the city’s overall planning area were included in the scope of medical insurance. The cause of physical education and sports has developed vigorously, and competitive sports have achieved great success again. In the whole year, Guangzhou athletes won 29 world championships in 25 events, 15 Asian championships in 9 events and 94 national championships in 51 events. At the 11th National Games held in Shandong, Guangzhou athletes got 18 first, 24 second and 12 third, with a score of 814.985, ranking first among all participating athletes in the province. There were 1985 national fitness activities and various mass sports competitions at the city, district and street levels, an increase of 48.47%. A total of 6,669,800 people participated in various national fitness activities throughout the year, an increase of 38.26%. The annual sales of sports lottery tickets reached 1.544 billion yuan, an increase of 36.5%. A multi-level social security system of social security and welfare has basically taken shape. At the end of the year, there were 6,080,300 medical insurance participants in the city, including 777,600 retirees. Pension (municipal and regional), unemployment and work injury (municipal and regional)The number of people participating in maternity insurance reached 4,153,400, 3,121,000, 3,551,000 and 1,661,300 respectively. There are 626,900 retirees (municipal and district-owned) who enjoy the old-age insurance benefits in the city, and 22,700 unemployed people receive unemployment insurance benefits. There are 45,400 people enjoying the minimum living security for urban residents and 70,600 people enjoying the minimum living security for rural residents. Social welfare undertakings continued to develop. By the end of the year, there were 178 social welfare institutions with 24,300 beds. Among them, there are 80 private social welfare institutions with 13,000 beds. There are 6 rescue stations and 122 community service centers in the city. In the whole year, 19,200 disabled people were employed; Disabled people received 2081 vocational skills training. 6. Population, Employment and People’s Livelihood The population grew steadily. At the end of the year, the number of permanent residents in the city was 10,334,500, an increase of 152,500 or 1.5% over the end of the previous year. The birth rate is 8.76‰, the death rate is 4.43 ‰ and the natural growth rate is 4.33‰. Employment and unemployment have expanded various forms of employment channels, and the number of employees has increased. At the end of the year, there were 7,367,300 social workers in the city, an increase of 3.1% over the end of the previous year. Among them, there were 798,400 employees in the primary industry, down by 0.1%; There were 2,971,600 employees in the secondary industry, an increase of 3.4%; The number of employees in the tertiary industry was 3,597,300, an increase of 3.6%.There were 4,340,600 urban employees, an increase of 3.3%. Increase employment assistance and reduce the registered unemployment rate in cities and towns. At the end of the year, there were 278,800 registered unemployed people in cities and towns, an increase of 18,200 over the end of the previous year; The registered urban unemployment rate was 2.25%, down by 0.07 percentage points. In the whole year, 195,300 registered unemployed people in cities and towns were resettled; Among them, 69,500 "4050" workers (laid-off and unemployed women aged 40 and men aged over 50) were placed in jobs. The employment rate of registered unemployed people in cities and towns reached 70.07%. By the end of the year, there were 511 employment agencies approved by the labor and social security departments in the city, and 1.504 million job seekers registered with various labor intermediary service agencies. Residents’ income and expenditure, and the income level of urban and rural residents has been continuously improved. According to a sample survey of urban and rural households, the annual per capita disposable income of urban households was 27,610 yuan, an increase of 9.1%. After deducting the price factor, the real increase was 11.9%. The per capita net income of rural households was 11,067 yuan, an increase of 12.6%. After deducting the price factor, the real increase was 15.4%. The consumption expenditure of urban and rural residents has increased steadily. In the whole year, the per capita consumption expenditure of urban households was 22,821 yuan, up by 9.5%. After deducting the price factor, the actual increase was 12.3%. Among them, the service consumption expenditure was 8369 yuan, up 9.7%, accounting for 36.7% of the consumption expenditure. The Engel coefficient of urban residents is 33.2%. The per capita living expenditure of rural households is 7742 yuan,An increase of 13.2%. The Engel coefficient of rural residents is 43.9%. Table 9: In 2009, the average number of durable consumer goods owned by urban and rural households per 100 households increased or decreased (%) compared with the previous year. City color TV station 148-10.3 Air conditioner station 2413.0 Refrigerator station 103-1.9 Camera stand 1004.2 Mobile phone department 252-1.2 Home computer station 1248.8 Home car 1918.8 Combination audio set 73 Flat washing machine station 1011.0 II, Rural color TV station 131-1.1 Air conditioner station 10514.0 Refrigerator station 87-2.2 Camera stand 307.1 Motorcycle vehicle 118-12.7 Mobile telephone department 2436.0 Home computer station 5813.1 Shower water heater station 972.9 Fixed telephone department 94-7.3 The living conditions and living environment of urban and rural residents have been continuously improved. In the whole year, the completed area of commercial housing in the city reached 7,156,800 square meters. At the end of the year, the per capita living area in urban areas reached 20.93 square meters, an increase of 0.39 square meters over the end of the previous year; The per capita housing area of rural residents reached 40.59 square meters, an increase of 1.86 square meters. Note: 1. The statistics in this bulletin are preliminary statistics except that the population and residents’ income and expenditure are annual reports; 2. The absolute values of regional GDP, added value and total output value are calculated at current prices; The growth rate is not only calculated by the current price of the total output value of the construction industry,The rest are calculated at comparable prices. 3. The data from 2006 to 2008 in the statistical chart have been revised according to the results of the economic census.

Extreme Fox Alpha S car purchase manual Yan value control is recognized as first-class at the same level.

What I brought to my riders today is. Let’s get to know each other.

First of all, from the appearance, the front face of the polar fox Alpha S looks beautiful and very sporty. Coupled with the stylish and simple headlights, it meets the "taste" of young consumers. The car is equipped with LED daytime running lights, automatic opening and closing, adaptive far and near light, automatic steering, delayed closing and so on. Coming to the side of the car, the car body size is 4980MM*1960MM*1599MM. The car adopts simple and generous lines, and the car body looks very simple. With large-sized thick-walled tires, it looks full of sports. In the design of the rear end, the rear end echoes the front face from a distance, and the taillight style is relatively cold. Overall, it is still relatively fashionable.

Sitting in the car, the interior style is very simple, which better enhances the sense of dignity. The steering wheel of the car is very young and made of genuine leather, which makes everything look very simple and fashionable. Take a look at the central control. The car is equipped with a cold touch-control LCD central control screen, which makes the interior style impressive and avant-garde. The dashboard and seats give people a good feeling, too. Let’s take a look. The dashboard design is remarkable, and the trendy design elements make people remember it at a glance. The car adopts leather-like seats, which are wide and thick, further improving the comfort of drivers and passengers.

The extreme fox Alpha S matches the gearbox, with an acceleration time of 6.4s seconds per 100 kilometers, and the power is completely OK for daily use.

The space in the back row of the Extreme Fox Alpha S is good, and it is no problem to meet the daily travel needs. In addition, the car is equipped with fatigue warning, anti-lock braking (ABS), LED daytime running lights, brake assist (EBA/BAS, etc.), brake force distribution (EBD) main driver airbag, co-pilot airbag, side airbag curtain, front side airbag and other safety configurations.

The car introduced today is not only eye-catching in space, but also has reached the mainstream level in various configurations, and there is nothing to be picky about driving experience and space experience. Xiaobian thinks that if you really want to buy this car, you still have to go offline to actually experience it.

Good news is coming! The total scale of intensive announcements of A-share companies exceeded 34 billion yuan.

On the evening of November 17,(301035) announced that the company passed the share repurchase on November 15, 2024.The account repurchased 177,600 shares of the company for the first time by centralized bidding, accounting for 0.06% of the company’s current total share capital. The highest transaction price was 50.38 yuan/share, the lowest transaction price was 49.72 yuan/share, and the total transaction amount was 8,874,900 yuan (excluding transaction costs). The sources of funds for this share repurchase are self-owned funds and special loan funds for stock repurchase.

At the beginning of this month, it has been withWeifang Branch of the Company Limited signed the Special Loan Contract for RMB Stock Repurchase, with the loan amount not exceeding RMB 130 million (inclusive) and not exceeding 70% of the repurchase amount. The purpose of the loan is to repurchase the company’s shares, and the loan period is one year. Compared with the proposed share repurchase scheme of 65 million yuan to 130 million yuan, the special loan support of financial institutions has effectively reduced the financial pressure.

(600850) On the evening of November 17th, it was announced that the controlling shareholder of the company, China Science and Technology (Group) Co., Ltd. (hereinafter referred to as "Group") and its concerted action, China Electronics Investment Holdings Co., Ltd. (hereinafter referred to as "Power Investment") had obtained the China respectively.Shanghai Jiading Sub-branch and Shanghai Pudong Development Co., Ltd.Commitment letter of special loan for increasing holdings issued by Beijing Branch of Co., Ltd.

Among them, it promises to provide a special loan of no more than 180 million yuan to Dianke Digital Group for the special loan project of stock increase of Dianke Digital Technology Co., Ltd., with a loan period of no more than one year.Commitment to provide special loans for stock holdings of CLP Digital Technology Co., Ltd. with a financing period of no more than one year, which does not exceed 140 million yuan.

On October 17th, 2024, China People’s General Administration of Financial Supervision and China Securities Regulatory Commission issued the Notice on Issues Related to the Establishment of Share Repurchase and Re-lending, announcing the official launch of the policy of stock repurchase and re-lending, which can be included in the scope of policy support for qualified listed companies and major shareholders to buy back and increase their shares. Subsequently, listed companies set off a wave of stock repurchase and increased loans.

At present, the first phase of 300 billion yuan repurchase and refinancing has entered the landing stage, and the application for repurchase or shareholder increase in loans by listed companies has made substantial progress. According to the information of the Shanghai Stock Exchange, as of November 16, the Shanghai Stock Exchange disclosed 78 repurchase announcements by using special loans, including 53 repurchase announcements with a total loan amount of 7.869 billion yuan; There were 25 announcements of increasing holdings, with a total loan of 8.405 billion yuan.

At the same time, as of 3: 00 pm on November 17th, 59 companies in Shenzhen disclosed that the total amount of repurchased special loans was 13.461 billion yuan, 11 companies announced that they had obtained the total amount of increased loans of 4.371 billion yuan, and 69 companies received the total amount of special loan support of 17.832 billion yuan.

According to incomplete statistics, in the last week (November 11-November 17), Runfeng shares, electronics figures,、、、、、、、、、、、、、、、、、、、、、、、、、、、、、、、、、、、、Nearly 40 listed companies, including others, disclosed information about repurchase and refinancing.

Among them, it was announced on the evening of November 13th that the controlling shareholder and its concerted action plan to increase the company’s shares by 2 billion to 4 billion yuan with its own funds and special loans. China, China、It will provide a total of no more than 2.8 billion yuan of special loan support for stock increase and repurchase.

On the evening of November 14th, it was disclosed that it was planned to increase the company’s A shares through the centralized bidding transaction of Shanghai Stock Exchange. The implementation period of the increase plan is 6 months from the date of this announcement, and there is no price range for the increase. The total amount of the increase is not less than RMB 150 million and not more than RMB 300 million. The capital source of this increase plan is the company’s own funds and the special increase loan provided by Ningbo Branch of the Company Limited, of which the amount of the special increase loan does not exceed 210 million yuan.

, etc., after the announcement of the proposed special loan repurchase or increase, the stock price closed at the daily limit the next day.

The real estate industry still has huge room for development.

The two giants in the Premier League compete for it! 27-year-old star wants to go: 68 games with 32 goals, priced at 80 million.

The 27-year-old Ivan Toni is once again caught in a transfer rumor. On November 1st, the British Evening Standard revealed that Chelsea and Arsenal, the two giants in the Premier League, are competing and hope to sign Tony in January next year. Brentford offered Tony a price of 80 million pounds, and the players sought to leave the team and play for a better club.

There is no doubt about Ivan Tony’s ability. In the Premier League in 2022-23, Tony scored 20 goals, ranking third in the top scorer list, only behind Harland (36 goals) and Kane (28 goals). During his Premier League career, Tony scored 32 goals in 68 games, and his efficiency was not bad. However, Tony got into big trouble: he bet on a football match, was banned by the FA for eight months, and will be released on January 17th next year.

The Evening Standard pointed out that brentford was willing to sell Ivan Toni for 80 million pounds. Objectively speaking, this price tag is somewhat inflated: Tony’s contract is only one and a half years, the player’s valuation in Germany is 30 million pounds, and he has not played a formal game for half a year.

There is no room for a big bodhisattva in a small temple. For his future, Ivan Tony is very clear: he wants to leave brentford and go to an "elite club". To this end, Ivan Toni also changed his agent and let Banert (who used to be Bell’s agent) handle his own transfer.

According to the analysis of the Evening Standard, both Arsenal and Chelsea intend to make moves in January next year:

Arsenal’s goal is still to compete for the Premier League title. If a scorer with 10 goals in the middle of the game is introduced in January, it will be of great help to the championship. Although Arsenal have Jesus and Nketiya, they are not prolific centers. Arsenal manager Artta appreciates Ivan Toni’s scoring ability. This summer, Arsenal spent 200 million pounds to bring in Tony in the winter window. The Gunners need to sell players to raise funds first.

Chelsea, with deep pockets, also intends to supplement the front line. Chelsea spent 1 billion pounds, completely overthrown and rebuilt, and there was not much improvement. This season, the Premier League only scored 12 points in 10 games and scored only 1.3 goals per game. In January next year, Jackson will play in the African Cup of Nations. Chelsea, which was originally weak in attack, needs Tony’s help.

Tony, who returned from the ban in January, hopes to complete the transfer in the winter window, seize the opportunity of half a year, strive for more goals, win the trust of English coach southgate and be selected for the European Cup 2024. As an excellent striker in the Premier League, Tony has only played for England once, which is not in line with his strength.

The "face value bubble" is broken, and beauty can only be rolled into scientific research.

People’s requirements for "face" are getting higher and higher, even to the point of harshness. "Yan value anxiety" was once one of the hot topics in the past.

Coupled with the improvement of economic strength, the beauty industry has experienced a period of rapid growth. According to the National Bureau of Statistics, the compound growth rate of retail sales of cosmetics above designated size reached 11.4% from 2017 to 2021.

At the same time, due to the environment, diet, aging and other reasons, most people do have different degrees of skin health problems, and the proportion of skin care products is also increasing. Domestic brands have launched a series of targeted skin care products by virtue of their in-depth understanding of Chinese skin, and their sales have also risen all the way. In 2021, the eight major beauty listed companies all recorded good revenue growth.

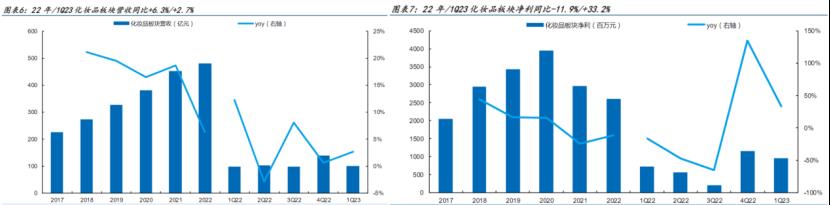

However, this scene changed in 2022, especially since the third quarter, many domestic beauty companies found that their products were becoming more and more difficult to sell. In 2022, the retail sales of cosmetics decreased by 4.5% year-on-year, and the situation of letting a hundred flowers blossom was long gone. Half of the companies fell into negative revenue growth.

(see the self-made map of intellectual research)

According to the research of Jianzhi, this should be analyzed from several aspects, and the external factor is the first one. Beauty cosmetics and skin care products are optional consumer goods. When faced with economic pressure or budget constraints, consumers may reduce their spending on non-essential items, so they are greatly affected by macroeconomics.

In addition, in the rapid development period of the past few years, in order to boost sales, e-commerce platforms have increased discounts and encouraged "the more you buy, the more discounts you get"; The traffic explosion of the super anchor also has some irrational consumption; Inventory that is difficult to sell in overseas epidemic situations enters China through cross-border e-commerce to consume inventory. Therefore, consumers’ household inventory is already at a high level, which is why we often hear that "what was bought in double 11 last year at 618 has not been opened".

In addition, the traffic dividends and platform dividends that have been discussed in the market in the past are also fading. This year, beauty companies and e-commerce platforms have become more rational. Like the 38 Goddess Festival in the first quarter of this year, Tmall did not make large-scale pre-sales and full reduction as before, and even the publicity was relatively low-key.

So, low growth will become the industry norm?

Let’s take a look at the performance of companies in the first quarter of this year. Who earns the most? Who has the strongest growth?

Overall, the overall environment of the beauty industry in the first quarter was still under pressure, and revenue only increased by 2.7% year-on-year (12.3% in the same period last year). However, the profit has been restored, and the net profit returned to the mother increased by 33.2% year-on-year (1% in the same period last year).

(Source: Guojin Securities)

Polaiya and shanghai jahwa were the most profitable companies in this quarter, with net profits of 210 million yuan and 230 million yuan respectively.

(see the self-made map of intellectual research)

As an outstanding student all the time, Polaiya continued its previous growth trend in the first quarter. For a detailed analysis, please refer to the previous article "The domestic beauty products are seriously divided, and Polaiya" wins hemp "with exclusive ingredients".

To put it simply, Polaiya’s highlight this year is the upgrade iteration of large items and the layout of new products, including cloud sunscreen and moisturizing series. In particular, the upgraded Shuangkang 3.0 was once again "sold out" and became the Top1 of Tmall’s liquid essence hot-selling list. According to the latest sales data in April, Polaiya’s growth is still steady. The GMV in Tmall flagship store and vibrato platform increased by about 54% year-on-year, so it is necessary to continue to pay attention to the sales of 618.

The performance of shanghai jahwa, another old brand of beauty cosmetics, has been unstable in recent years. Especially last year, due to the epidemic situation and the lack of super-anchor, both revenue and net profit returned to the mother decreased, and the net profit returned to the mother decreased by 27.29% year-on-year.

However, after entering 2023, shanghai jahwa’s income situation has improved (the income of skin care products in 22 /23Q1 was 1.98 billion yuan/410 million yuan, respectively, down by 26.8%/8.6%, and the decline was narrowed). In addition, with the new single product oil-sensitive cream, the sales data in April showed a rising trend. In the Tmall flagship store and Tik Tok, the GMV of Yuze and herborist brands increased by about 81% year-on-year, and the chain has also turned positive significantly (among them, the large single product oil sensitive cream contributed more than 20% in the GMV of Yuze Tmall flagship store; Tai Chi Repair Kit and New Seven Whitening Kit contributed over 35% to GMV in herborist Tmall flagship store).

The fastest growing beauty companies include Shuiyang and Marumi, in addition to Polaiya, which has just been mentioned. The net profit of these companies has increased by more than 20%.

Although Marubi shares have been affected by the external environment and the company’s promotion of online channel transformation in the past few years, the growth rate of net profit returned to the mother has been negative for three consecutive years. However, in the first quarter of this year, Marumi saw the effect of transformation, and the recovery growth continued until April.

In April, the total GMV of Marumi’s main brand in Tmall flagship store and Tik Tok Shanghai increased by 143% year-on-year, and the new recombinant collagen suit successfully ranked among the Top2 products in Tik Tok. At the same time, Love Fire also maintained rapid growth on multiple platforms, with a total growth rate of 180%, and the sales of explosive "invisible liquid foundation" accounted for about 30%.

The sales of Shuiyang shares also improved marginally. In April, the GMV of its brands, Royal Mud Workshop, Big Water Drop and Ifedan, increased by about 56% year-on-year. Among them, Ifidan’s Super Mask was successfully registered in Li Jiaqi Live Room, which promoted the GMV of its Tmall flagship store to increase by 823% year-on-year.

In addition, it is worth mentioning that although listed companies in Hong Kong stocks do not disclose a quarterly report, in the sales station in April, Juzi Bio and Shangmei also achieved good results. The "Fumei" and "Kelijin" of Juzi Bio increased by about 52% in Tmall flagship store and GMV in Tik Tok. The brand "Kanshu" of Shangmei Co., Ltd. is growing even more dramatically, with GMV increasing by about 229% year-on-year, and Tik Tok’s growth is as high as 320%. Its monthly sales rank second in Tik Tok’s beauty brand and first in domestic products.

Generally speaking, after four years of rapid growth from 2017 to 2021, the beauty industry is gradually entering a platform period, that is, the growth rate of the industry is relatively slow, and the differentiation among different brands is more serious. Although the leading company Polaiya still maintains a higher growth rate than the whole industry, the growth rate of Huaxi Bio and Betani, which used to have high growth, has obviously slowed down, and even some companies have fallen behind.

However, we also saw that companies such as Shuiyang and Marumi, which suffered serious losses in 2022, ushered in marginal improvement in the first quarter and April of this year.

So where is the next round of high growth? Which companies can seize the opportunity?

As we all know, in the period of rapid growth of the beauty industry, major brands will invest a lot of marketing expenses and constantly introduce new products in order to seize market share. However, as the market entered the platform period, both the brand and the platform began to be more rational, and the focus returned to the product itself.

Take Huaxi Bio as an example, the sub-brand Quadi used to grow at the rate of doubling every year, but since 2022, the growth rate has slowed down obviously. In the first quarter of this year, Huaxi’s growth was still under pressure from the launch of new products, and there was no obvious upward trend. This year, the company also took the initiative to reduce the revenue growth target to 15%-20%.

What is more important for Huaxi this year is to enhance brand value. In order to make the new anti-aging eye cream quickly occupy consumers’ minds, Quadi even made a detailed interpretation of the market trend, and took the new packaging technology as a selling point, claiming that it could promote the penetration of active ingredients, thus greatly increasing the customer unit price (the new product "Zhen Jin Yun Huo Eye Cream" was 498 yuan /20g, while the old green obsidian eye cream was 238 yuan /18g).

According to Jianzhi research, the purpose of a lot of market research and publicity in Quadi’s early stage is to establish a professional and reliable image and make anti-aging more deeply rooted in people’s hearts. The addition of new technology and the upgrading of efficiency are all important means to increase the unit price of customers. At present, the new eye cream ranks second in Taobao’s new product list, second only to L ‘Oré al 20 Eye Cream, but the actual sales volume and use effect need to be continuously tracked.

Similar to Huaxi’s biological situation is Betani. This year, Bettini focused on upgrading Winona Shu Min Moisturizing Cream and promoting the high-end brand AOXMED. In the future, consumers will make immediate repairs after finishing medical beauty, which may not only use dressings, but also use more essences and creams to enhance their efficacy.

Another great event of Betani is that she clearly put forward the idea of getting into the beauty of military doctors in last year’s annual report.

According to the knowledge of Jianzhi Research, Betani is making efforts to the track of life beauty instrument.

Before, home beauty instruments were on fire in the market for a while, but due to several safety accidents, home beauty instruments were subject to stricter supervision. Among them, pulsed light hair removal products have been classified as Class II medical devices, and RF products with higher risk factors have been included in Class III medical devices for management since last month.

Betani is likely to get the certificate of Class II medical devices first, and then gradually expand to the beauty instrument of Class III medical devices. In fact, the life beauty instrument track has a large room for growth, and specialization and standardization will become an inevitable trend, which may open up new growth points for Betaine in the future. At the same time, the company will definitely introduce skin care products that match the beauty instrument, because the purchase frequency of the beauty instrument is relatively low, and the matching skin care products can be supplemented frequently.

Generally speaking, the beauty industry is stepping into the platform period from the high-speed growth period, which is mainly reflected in the slowdown of the overall industry growth, the performance differentiation among different brands and the difference in development focus.

With the continuous development of dermatology, products will be more refined and provide precise solutions for different skin needs. Future competition will pay more attention to the application of core needs, dermatology and precision technology. Brands need to focus on the mental cultivation of consumers and the layout of new products in order to gain a competitive advantage in the next growth period.

This article is from Wall Street. Welcome to download the APP to see more.