Image source @ vision china

After eight days, Hua Xizi finally spoke.

However, the statement did not respond to the high-priced controversy, but reiterated its brand vision as a domestic beauty brand "promoting the beauty of the East and casting a century-old national makeup".

Whether this statement can satisfy consumers who have previously felt "backstab" or not. It is almost a consensus that it is not so easy for "all girls" to buy it.

More and more rational, they are using actions to announce the failure of their price and sentiment cards to the brand.Since the price dispute, they have been saying, "Who is not a domestic product? Who will feel sorry for me?" Take off the emotional binding, while comparing the domestic make-up with the gold price, and measure the cost performance with the accurate price comparison method.

At the same time, it is obvious that Li Jiaqi has had a hard time recently.

Being questioned and apologizing twice failed to quell dissatisfaction. It seems that this matter can’t pass if the powder continues to fall, the topic is constantly derived, and the heat persists for a long time.

Image source @ Little Red Book Davidkwok

Looking back from the time corridor, on the one hand, Li Jiaqi, who has grown into the "first brother" by virtue of his low price advantage and high emotional value, and on the other hand, the light of domestic products, which embodies consumers’ feelings and high cost performance expectations.The rise and fall of the two are so similar and intertwined.

Now, the other side of Li Jiaqi being questioned is the dilemma of domestic beauty cosmetics.

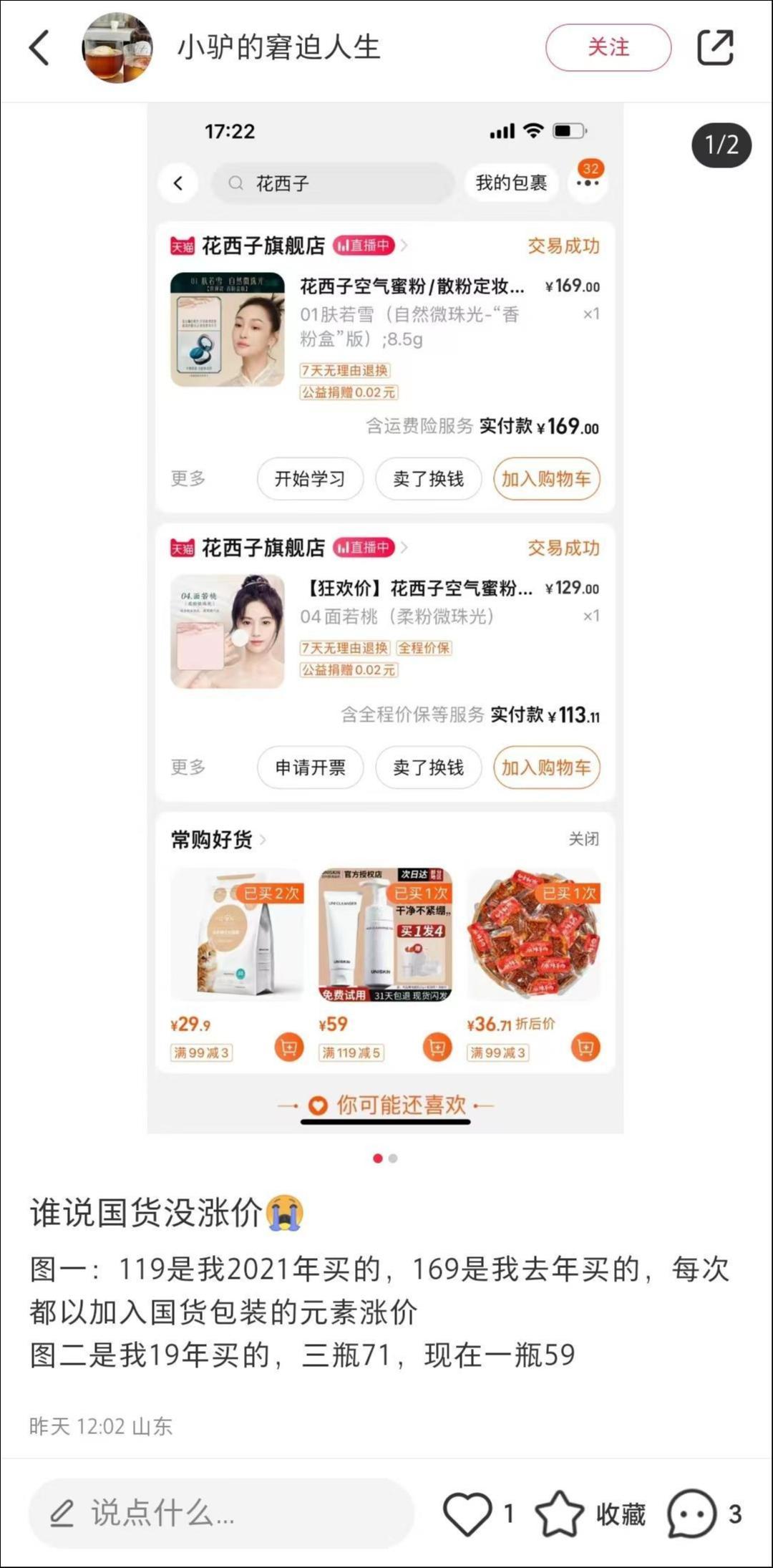

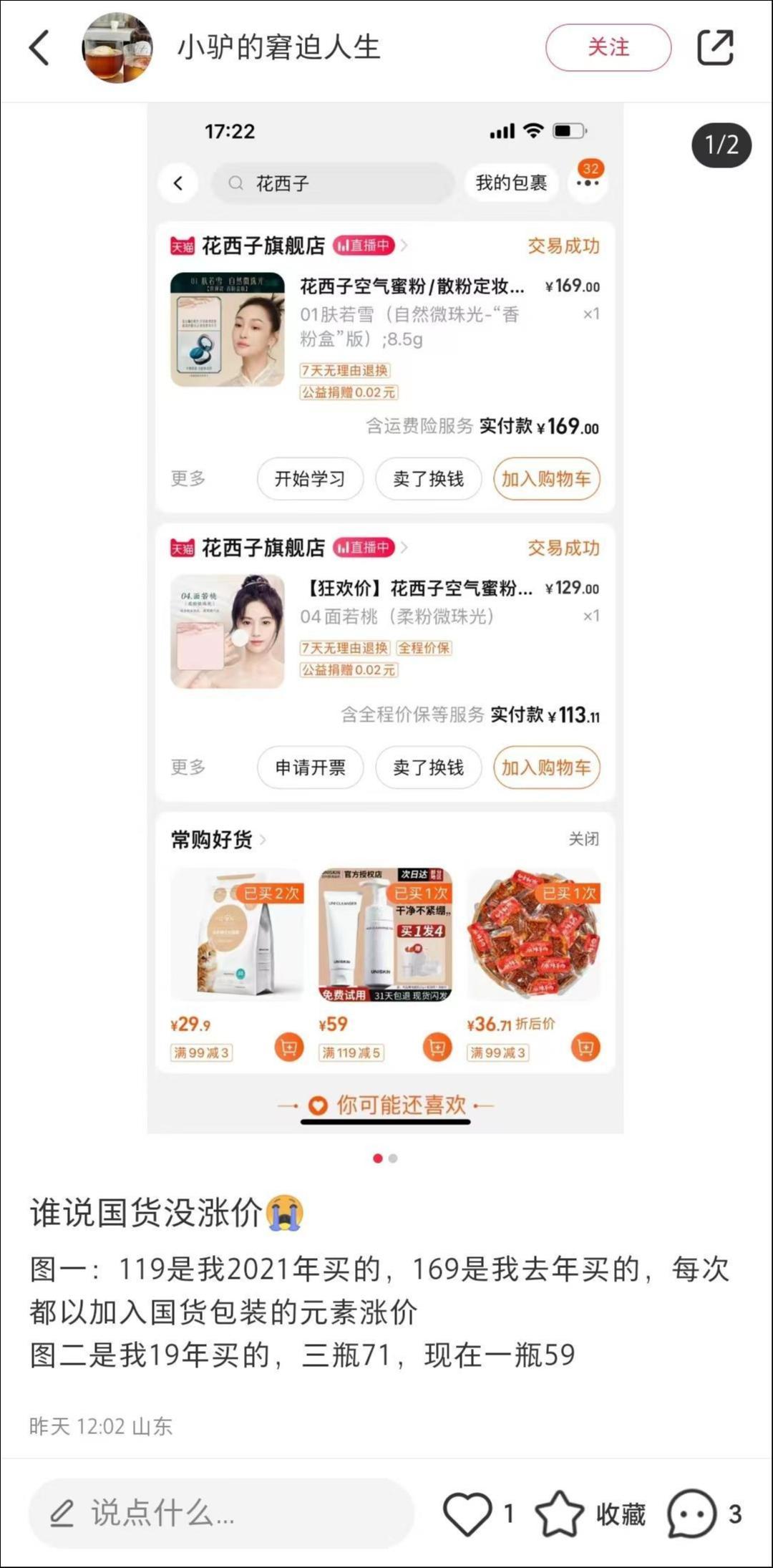

More and more consumers are beginning to feel that domestic products are becoming more and more expensive. They show their feelings and seek resonance by taking screenshots of their past orders on social media.

Image source @ Xiaohongshu Xiao Lv’s embarrassing life

Is this really the case?

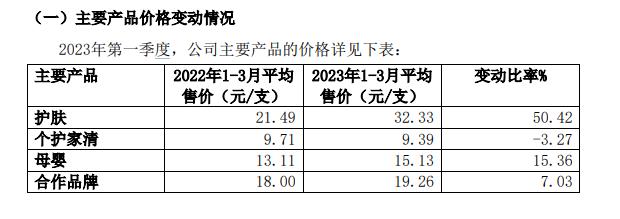

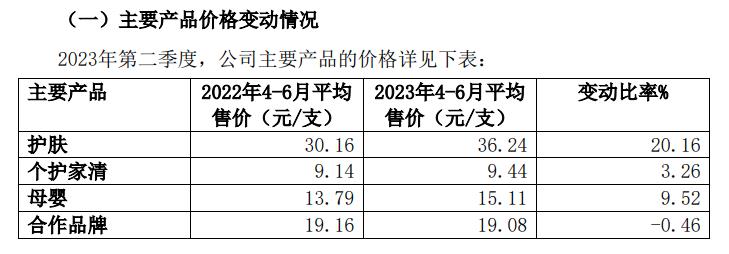

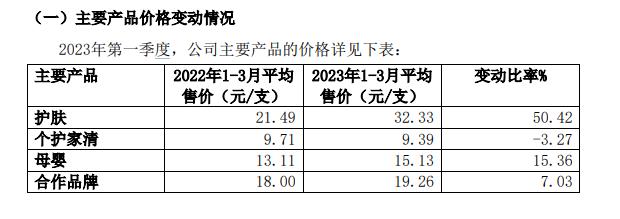

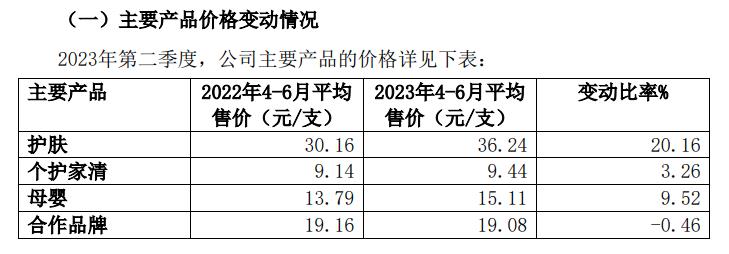

Take shanghai jahwa, which owns well-known brands such as Liushen, Meijiajing, herborist, Qichu and Yuze, as an example. According to the announcement of its main business data, the average price of skin care products in the first half of this year and the second quarter of this year increased by 50.42% and 20.16% respectively compared with the same period of last year, which helped its skin care products achieve positive revenue growth.

Image source @ shanghai jahwa’s main business data announcement in the first quarter of 2023

Image source @ shanghai jahwa main business data announcement in the second quarter of 2023

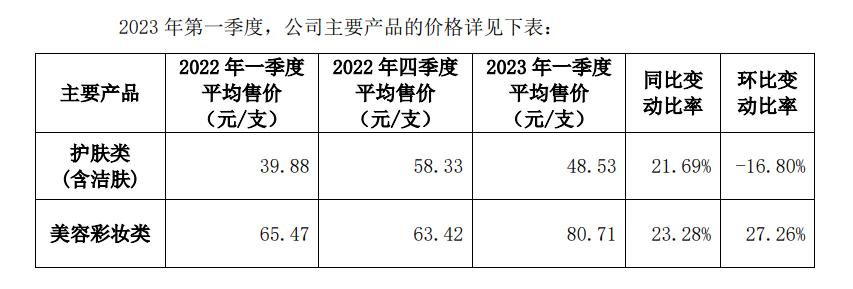

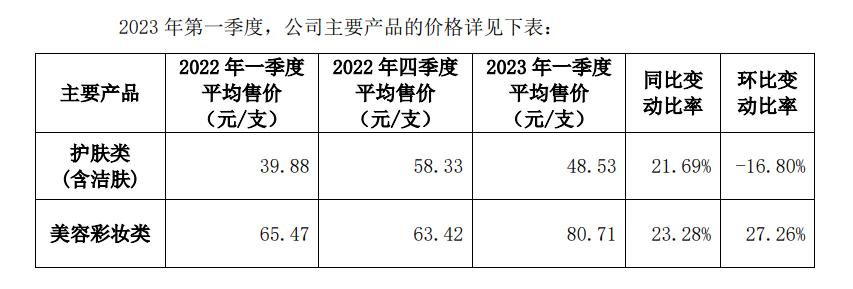

Look at Polaiya, the parent company of Polaiya, Yuefushan and Caitang. In the first quarter of 2023, the skin care products and beauty cosmetics products of Polaiya increased by 21.69% and 23.28% respectively.

Image source @ Proya’s main business data announcement in the first quarter of 2023

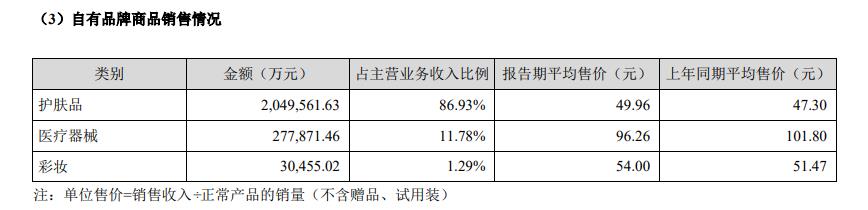

In addition, in the first and second quarters of 2023, the average selling price of Marubi skin care products increased by 39.76% and 14.83% respectively, and the average selling price of beauty products increased by 27.22% and 15.90%. In the first half of 2023, the price of skin care products increased by 5.6% and the price of cosmetics increased by 4.9%.

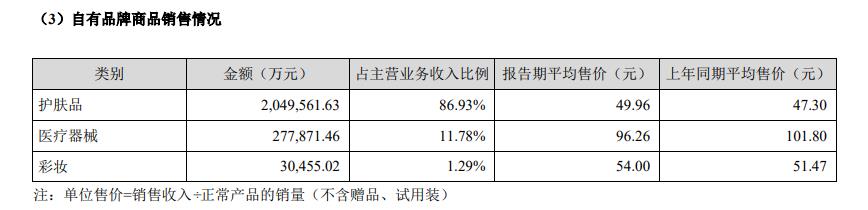

Image source @ Betani 2023 semi-annual report

It can be seen that the price increase that consumers feel is not groundless.

From the main cost performance to "more and more expensive", the rising price of raw materials may be the reason that cannot be ignored.

At present, the key raw materials used by domestic skin care and beauty enterprises mainly rely on imports from the United States, Germany, Japan, South Korea and other countries, such as surfactants for cosmetics, thickeners, high-performance oils and fats, and high-safety preservatives. Therefore, the fluctuation of the supply price of upstream raw materials will indeed greatly affect the beauty and skin care brands.

Since the epidemic, the price increase of some basic raw materials, such as glycerol, has been particularly obvious.

Recently, many giants such as Dow Chemical, Japan PE Co., Ltd., Japan PP Co., Ltd., Sanyo Chemical, Longbai Group, etc. also announced price increases ranging from 5% to 23%, involving cosmetic raw materials such as silicone, surfactant, PMMA, PP, PE and titanium dioxide used as a physical sunscreen, and the price per ton directly exceeded 1,700 yuan.

Polaiya also said in the announcement that the prices of its main products, ruby and active substances with strong efficacy, have increased significantly-the average unit price in the first quarter of 2023 increased by 305.85/kg, an increase of 116.05%.

With the rising cost of raw materials, it is not only domestic brands that raise prices. However, the price increase of international big brands is much milder.

For example, the financial report of consumer goods giant Unilever shows that the price of beauty and health care products rose by 7.5% in fiscal year 2022.

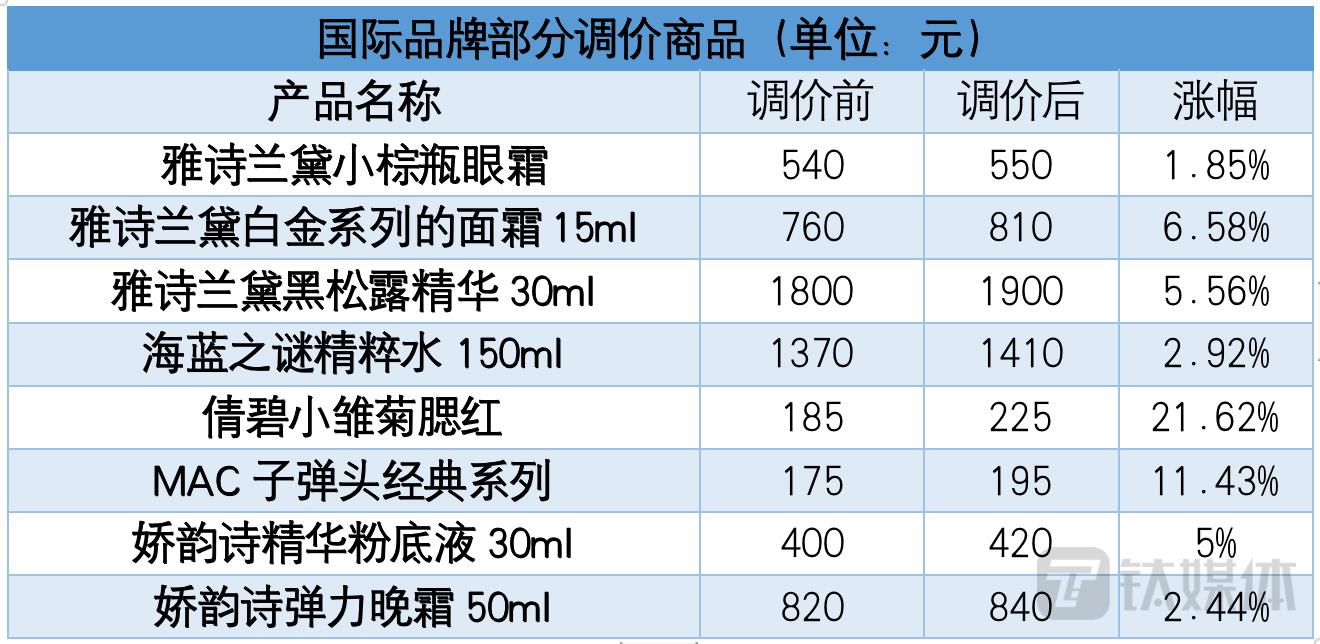

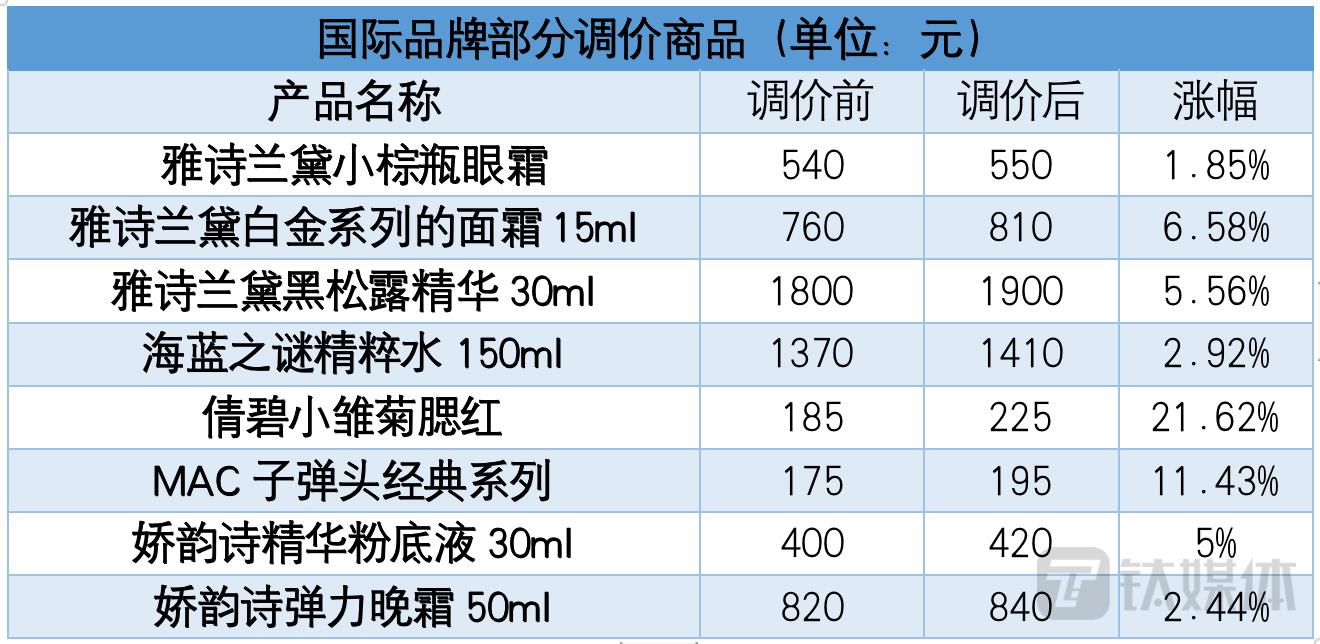

Estee Lauder Group has also raised the price of its products twice in 2023, involving many of its star products, but the increase is relatively limited except Clinique Little Daisy Blush.

Data Source @ Official Flagship Store, Cartography @ Titanium Media APP

In this way,The rising cost caused by the rising price of raw materials is not enough to explain why domestic brands have changed from "flat replacement" to "expensive replacement".

The huge marketing expenses, including the commission of the anchor with goods, are another main reason.

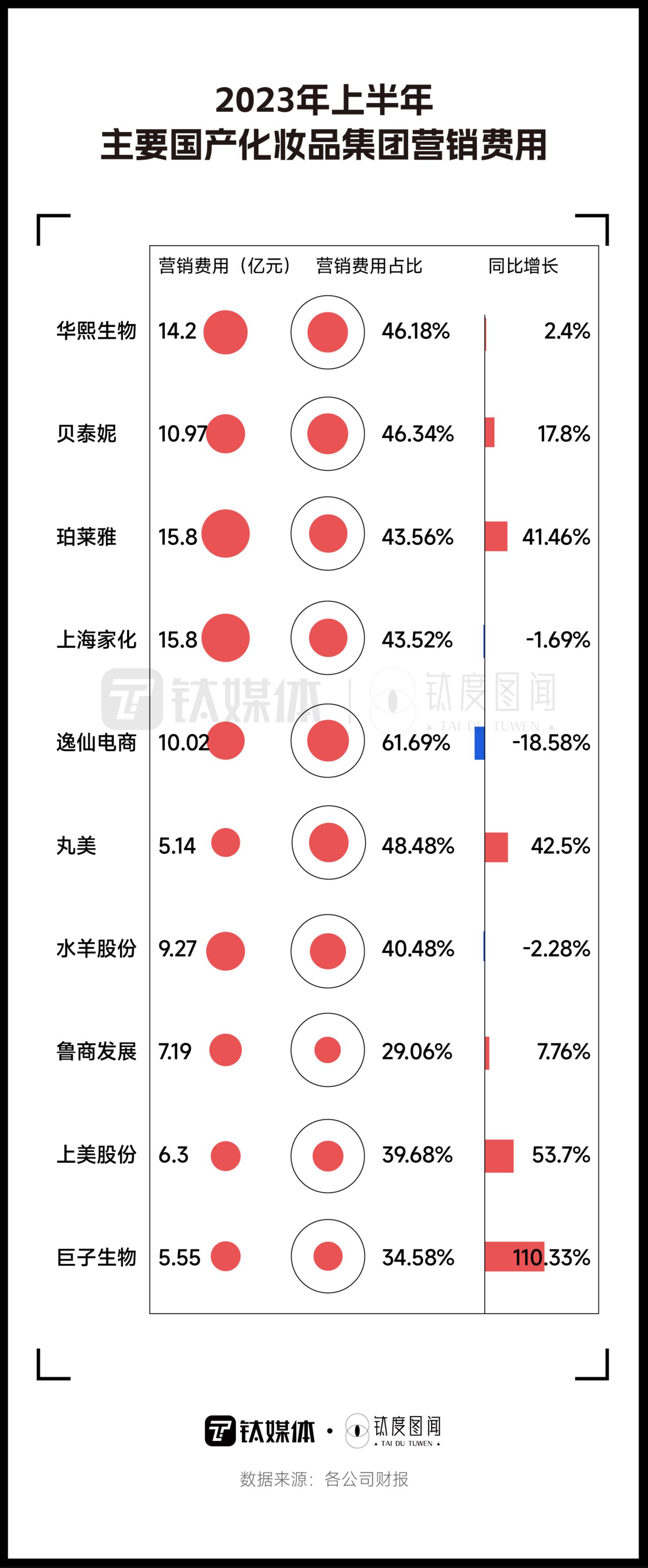

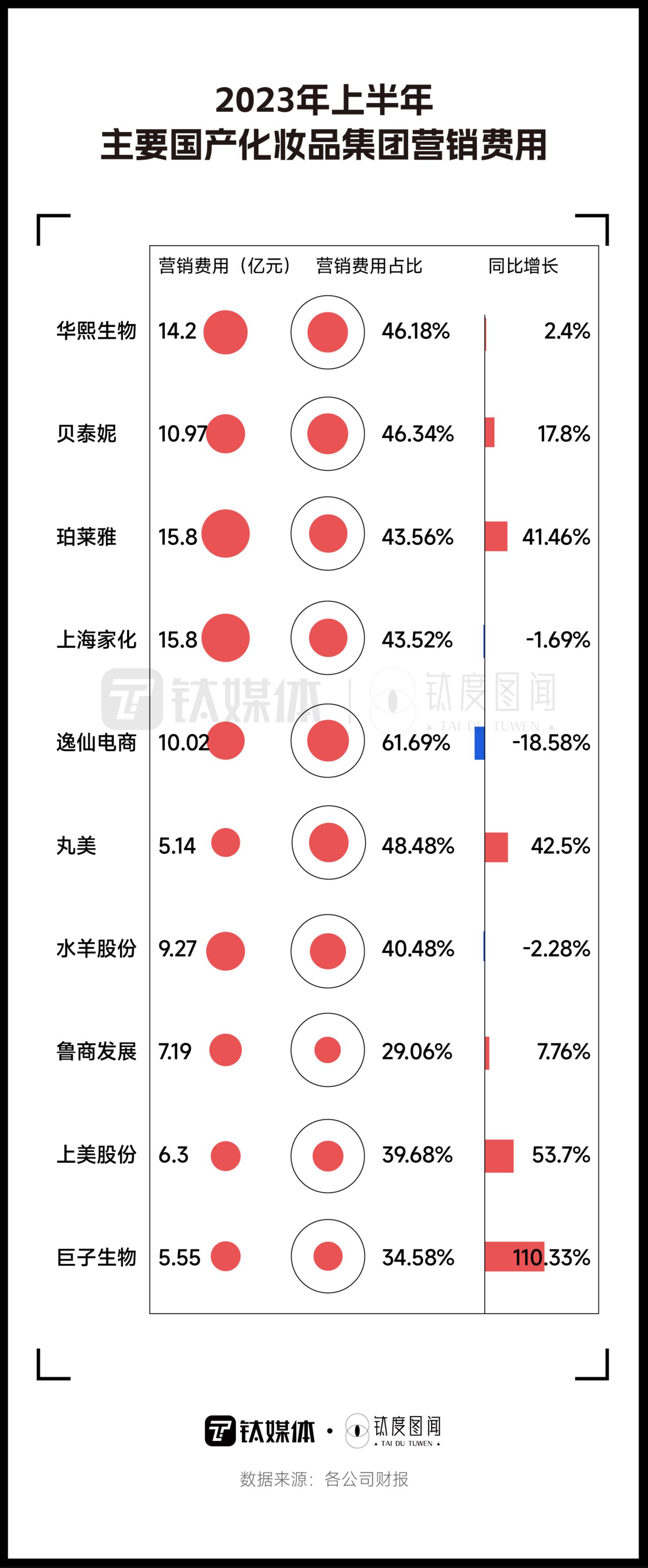

According to the financial report data released by various companies, the sales expenses of various beauty products accounted for about 45% of the revenue in the first half of this year, and the parent company of Perfect Diary, Yixian E-commerce, had the highest proportion, accounting for 61.69%.

Image source @ 么么么么么么么么么么么么么么么么么么么么

Comparing the marketing expense rate of international brands such as Estee Lauder, Shiseido and L ‘Oreal, which is around 30%, we can see that domestic beauty brands are highly dependent on marketing.

This is actually related to the growth experience of domestic beauty brands.

A few years before the flood of new domestic brands emerged, the grass planting economy was just emerging and the online traffic cost was still relatively low. At that time, most of the new beauty brands were established in a short time, with small capital scale, and their ability to lay offline sales channels was limited. Therefore,In the early days of its establishment, online became the main position for the marketing and sales of domestic beauty brands.

At that time, an unwritten explosive formula was popular in the industry: "5,000 little red books+2,000 Zhihu questions and answers+head anchor with goods = a new brand".Seize the user’s mind and achieve explosive growth through marketing, which has almost become the standard of new brands of domestic beauty.

Take Huaxi Zi in this storm as an example. Founded in 2017, it is experiencing a channel dilemma when it comes into contact with the live broadcast room in Li Jiaqi in 2018. At that time, Li Jiaqi had just defeated Ma Yun in the Double Eleven PK selling lipstick, and began to emerge in the field of e-commerce live broadcast.

Looking back on the five years when Hua Xizi and Li Jiaqi were deeply bound, many sales miracles occurred at this time: in 2019, "double 11" sold 700,000 boxes of loose powder of Hua Xizi; In 2020, "618" Hua Xizi became the first in the turnover list of domestic beauty products with GMV of 235 million yuan, and its revenue jumped from 10 million to several billion. According to the quality statistics, from January to February, 2020, 40% of the sales of Huaxizi flagship store came from the live broadcast room in Li Jiaqi.

Hua Xizi’s growth experience is only a typical representative of domestic beauty, and there are also perfect diaries, orange blossoms, Yuze and so on.

Over-reliance on online marketing has made many domestic beauty products form a revenue-driven growth model.

Take Yixian E-commerce, the parent company of Perfect Diary, which was listed on the US stock market only three years after its birth, as an example. According to its announcement data, from 2018 to 2020, Yixian E-commerce spent 309 million yuan, 1.251 billion yuan and 3.412 billion yuan on sales and marketing respectively, with the highest proportion accounting for 65.2% of the total revenue. With the rising marketing expenses, its scale has also been rapidly expanded.

However, with the contraction of marketing expenses by Perfect Diary, its operating income is also affected simultaneously: in the first quarter and the second quarter of this year, the proportion of marketing expenses of Yixian e-commerce decreased by 7.9% and 2.5% respectively compared with the same period of last year, and the total net income decreased by 14.1% and 9.8% respectively.

More seriously, with the surge in online traffic costs,Many domestic beauty brands are caught in the "strange circle" cycle of exchanging marketing for revenue.That is to say, if marketing is reduced, revenue may decline, but if marketing is maintained, high traffic cost will cause losses, and even it may fall into a negative cycle of more money burning and more losses.

In this way, the price increase has become a natural choice in the dilemma of domestic beauty.

At the same time of rising prices,A large number of domestic beauty brands are disappearing in invisible places.

According to incomplete statistics, from June 2022 to now, there are about 12 cutting-edge makeup brands that have declared bankruptcy/clearance/suspension. Among them, there are some brands that have exploded, such as floating Fomomy and Kale said Colorpedia, which shows that the market competition is fierce.

Cartography: titanium media APP

Consumers’ enthusiasm for buying domestic beauty brands has also begun to cool down.

In this year’s TOP20 of Tmall’s 618 beauty industry, only four domestic brands entered the list, namely Polaiya, Winona, Fumei and Shuguang, and the corresponding rankings were TOP4, TOP9, TOP13 and TOP19.

Image source @ tmall beauty cosmetics

Looking back at the development of domestic beauty brands in the past ten years, the market share has increased from 15% in 2012 to 28.8% in 2021.

However, while we are excited about this, we should also see the fragility of relying on short-term marketing strategies and transferring costs through price increases.

Cosmetics, as a complex mixture of various raw materials, as the core active ingredient and the production technology such as fermentation and synthesis technology, are the key to build its core competitiveness.

In the process of the rise of international beauty products, many brands rely on core ingredients and production process barriers to build a protective city. Take L ‘Oré al’s self-developed Bose factor as an example. Since the successful research in 2000, helena rubinstein, Lancome, Xiuliko, YSL and Yuxi have all participated in Bose factor, occupying the forefront of the anti-aging category. The unique fermentation process of the core ingredient Pitera in the immortal water also helped SK-II build its core competitiveness.

However, R&D capability and core production capability are the disadvantages of domestic brands.

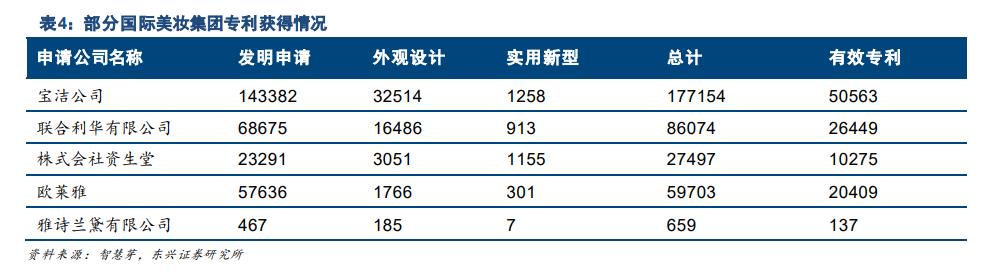

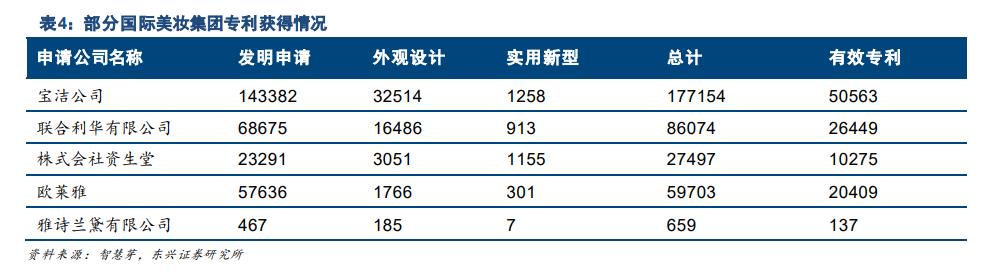

According to the statistics of Dongxing Securities, as of 15th, 2022, the number of patents of Procter & Gamble and Unilever reached 177,154 and 86,074 respectively, and mainly concentrated on inventions with higher gold content and longer patent protection period.

Image source @ Dongxing Securities

According to the data of Tianyancha, the number of patents of shanghai jahwa, Betani, Marubi, Huaxi Bio and Yixian E-commerce are 1650, 244, 396, 646 and 174 respectively, and among the patents in shanghai jahwa, the design category with relatively low gold content accounts for 80.24%; By 2022, Yixian e-commerce has 174 patents worldwide, of which 43 are invention patents.

Image source @ Tianyancha

Image source @ Tianyancha

In addition, domestic beauty products mostly adopt OEM OEM mode, lacking the ability and technology of self-built factory production.

Under this model, the upstream foundry masters the core production technologies such as raw material extraction and preparation, synthetic biotechnology, etc., while the brand side is often caught in homogenization competition, making it difficult to build a brand moat.

Take the category of freeze-dried mask. As a rapidly growing sub-category in recent years, there have been many explosive products. For example, in 2020, the SKU of Yuze freeze-dried mask will reach 2 billion; In 2021, Winona’s double eleven pre-sale freeze-dried mask products were pre-sold in three seconds.

But in fact, these explosions, such as Yuze Centella asiatica reassuring repair mask, Winona soothing repair freeze-dried mask, and Appropriate Herbal Gentian reassuring repair freeze-dried mask, were all made by the same foundry that mastered the core freeze-dried mask technology-Weibo Haitai.

According to the information, Weibo Haitai has cooperated with many brands to list dozens of masks and essence products of herborist, Yuze, L ‘Oreal, Ke Beili, Yiyibucao, Winona, Royal Nifang and Liangliang.

Under such fierce competition of homogeneous products, it is difficult to impress today’s consumers only by fighting for low prices and "selling badly"It has become an industry consensus to improve R&D capability, increase investment in innovation and improve product quality.

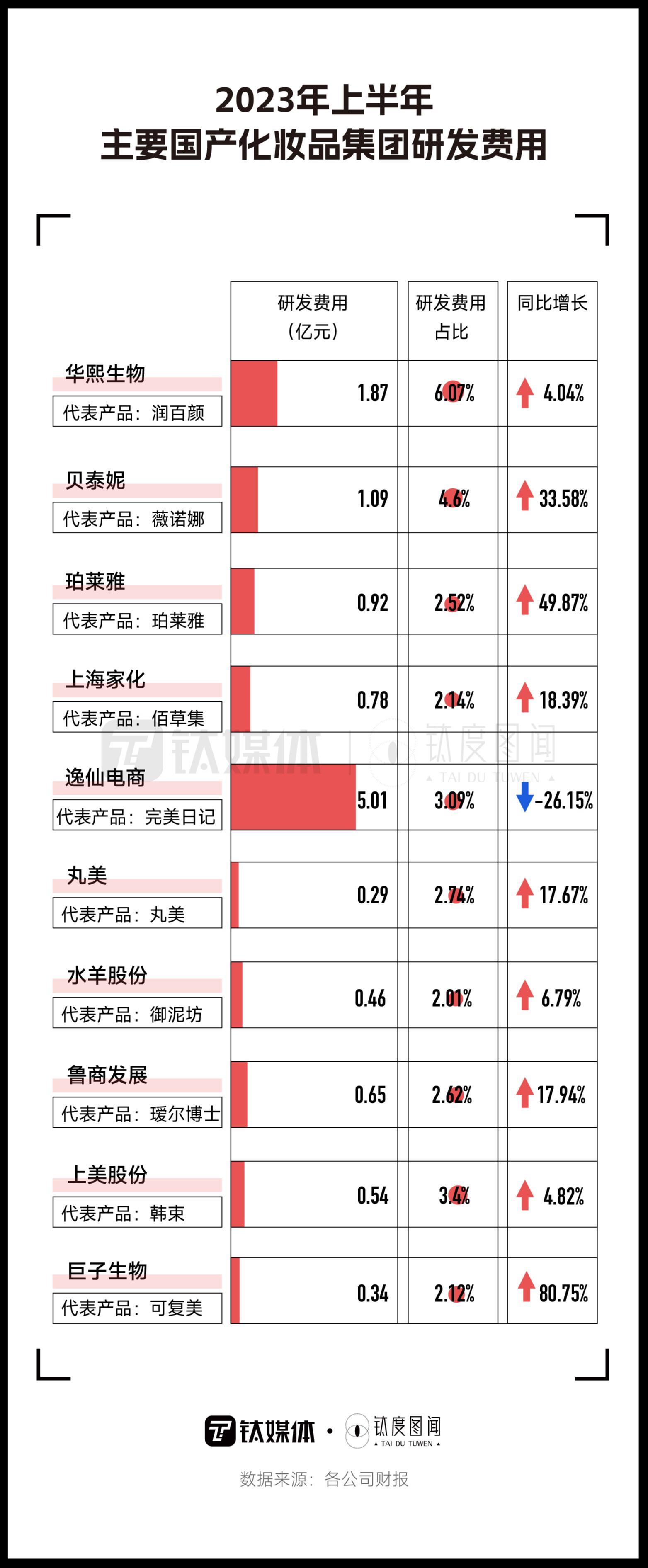

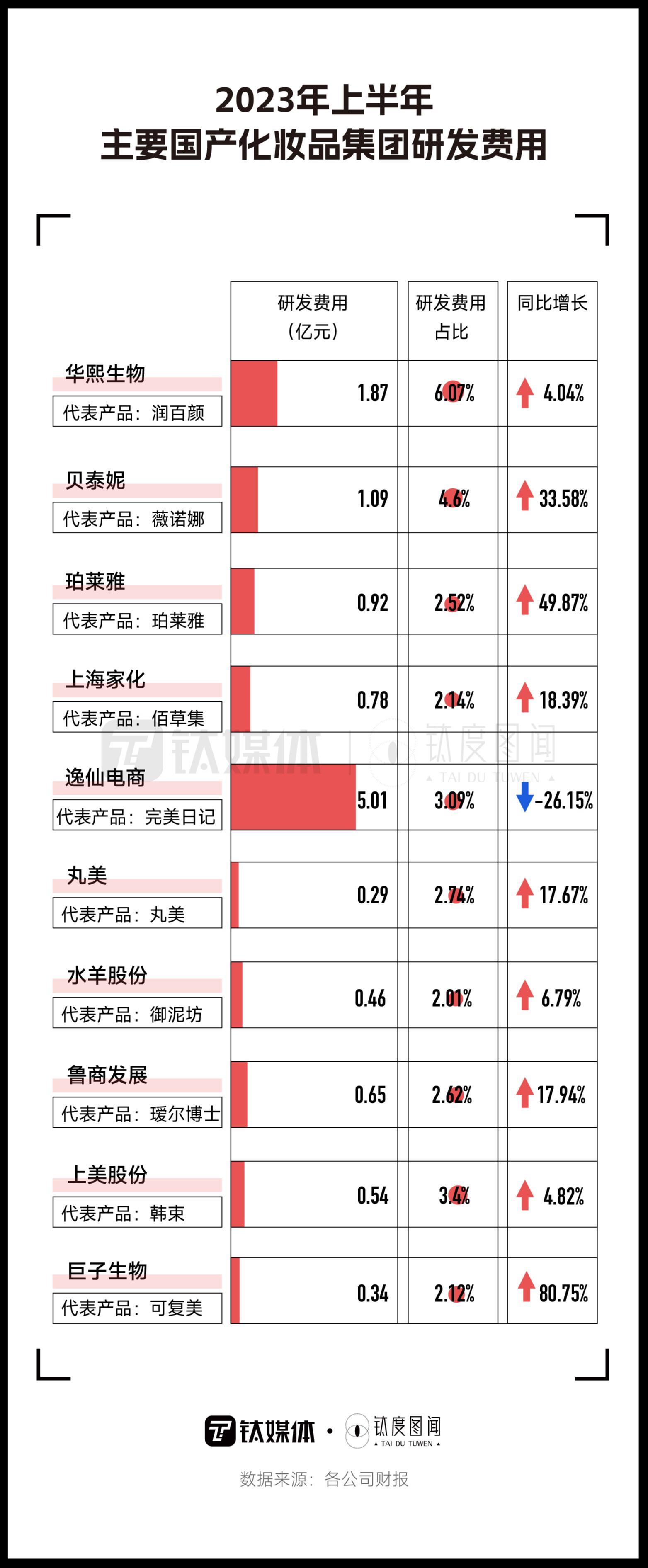

In the first half of this year, the proportion of research and development expenses of domestic beauty cosmetics has increased to varying degrees. Huaxi Bio invested 187 million yuan in research and development in the first half of 2023, accounting for more than 6%; Betani’s R&D investment accounted for more than 4%, up 33.58% year-on-year; The R&D expenses of Giant Bio increased year-on-year, reaching 80.75%.

Image source @ 么么么么么么么么么么么么么么么么么么么么

In addition to research and development, domestic beauty brands are also making up for shortcomings.

For example, in August this year, the first factory of Yixian E-commerce was put into operation, integrating R&D, manufacturing and quality control, trying to build a moat through self-built factories; Winona gradually diversified her own sales channels, vigorously added more offline, and tried to get rid of single dependence.

Some domestic beauty products have gone abroad and started to show their strength on the international stage.

According to public data, Hua Xizi has been sold to Japan, the United States, Europe and other countries and regions; And relying on "girl’s heart" to win Lolita’s favorite flower knowledge has also caused repercussions in the Japanese market.

The process of the rising of domestic beauty products is doomed to be not smooth sailing. Only by reducing the low cost and increasing the consumption of feelings, a stable and far-reaching brand is bound to fail.

With the continuous evolution of these brands, more possibilities will be created in the future. May a hundred flowers blossom and domestic products become stronger.(This article is the first titanium media APP, written by Yuan Ning, edited by Zhao Hongyu)

references

- Q2 Skin Care Products’ Restorative Growth, Focus on Performance Repair and Omni-channel Development of Key Brands in the Future-china galaxy Securities Research Institute