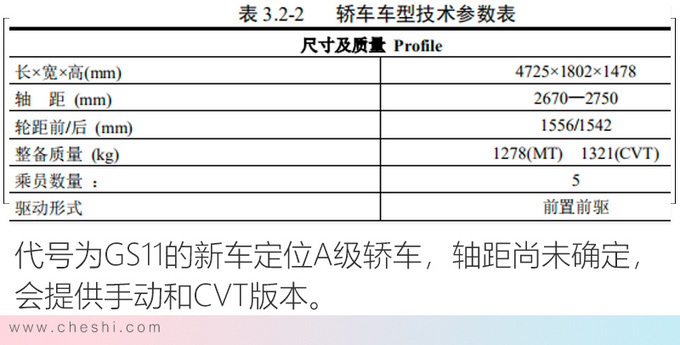

The Landmap of "Riding the East Wind" was the "blueprint" for realizing Dongfeng, and Dongfeng, which made tens of billions of dollars in annual profits, also began to find a "way back".

"Landmap wants to outperform large automobile groups such as Volkswagen and Toyota in the new energy era, and at the same time complete the leap of domestic high-end." Landmap was very ambitious when it was first established in 2020;

"Landmap carries the dual mission of Dongfeng’s brand improvement and exploring a new model of independent brand development." Dongfeng has high hopes for it;

"Landmap wants to achieve profitability next year" has become the task of Landmap in 2022.

Landscape had built a grand "blueprint" since its birth, but they did not know that Landscape was now a little powerless. Dongfeng Group, which originally wanted to achieve its high-end dream of independence with Landscape, also left a "back hand" to find a replacement for itself.

Sales are declining, "more than enough but less than enough"

Recently, Dongfeng Motor Group announced the latest production and sales data, September Lantu car sales of 2519, 1-9 cumulative sales of 13,600, since the delivery of the first car in August 2021, so far Lantu cumulative delivery of 20,400.

Although Lantu has repeatedly lowered its annual sales target, the possibility of completing the target is minimal. At the beginning of this year, Lantu set an annual sales target of 46,000 vehicles, but from the sales performance of 6878 vehicles delivered by Lantu in the first half of this year, it only completed 14.95% of the target; in the second half of this year, Lantu lowered the annual sales target to 31,000 vehicles, but from the current sales performance, it only completed 35.8% of the annual target.

Such achievements made Dongfeng, who "wants to use Lantu to develop his own brand", a little uneasy. At present, the independent passenger car brands under Dongfeng Group that contribute sales include Dongfeng Fengxing, Dongfeng Fengshen and Lantu, but according to relevant data, the cumulative sales of Dongfeng’s independent passenger car brands are less than 2% of the national narrow passenger car market share.

According to the data of the Passenger Federation, the cumulative sales volume of narrow passenger cars in the first nine months 14.875 million, an increase of 2.4% year-on-year.

Sales did not meet expectations, and Lantu’s losses gradually expanded. Relevant data show that in 2021, Lantu’s annual revenue was 1.767 billion yuan, total profit loss was 965 million yuan, and net profit loss was 703 million yuan; in the first half of this year, Lantu achieved revenue of 1.887 billion yuan.The total profit loss was 1.025 billion yuan, and the net profit loss was 738 million yuan.

Picture source: Photo by reporter Sun Tongtong (data map)

At the same time, the already unprofitable Landmap has also fallen into a situation of high debt. According to relevant data, in the first half of this year, Landmap’s total assets were 7.412 billion yuan, total liabilities were 6.529 billion yuan, and the asset-liability ratio was as high as 88%; in 2021, Landmap’s total assets were 6 billion yuan, total liabilities were 4.589 billion yuan, and the asset-liability ratio was 76.48%. In half a year, Landmap’s asset-liability ratio rose by 10%.

It is worth noting that Dongfeng Group has spent a lot of effort on Lantu, using the money saved by the joint venture brand to support Lantu, which has suffered losses for three consecutive years. According to Dongfeng’s latest financial report, Dongfeng Group’s net profit to the parent in the first half of this year was 5.529 billion yuan, down 35.81% year-on-year.

What makes Dongfeng even more humiliating is that Xiaokang shares, which were almost delisted from the market, are now at the forefront of new energy vehicles. Xiaokang Sailis has gradually increased its sales since it launched the AITO Q brand in cooperation with Huawei. According to sales data, Sailis sold 17,596 new energy vehicles in September, an increase of 341.33% year-on-year. Among them, Sailis sold 10,142 vehicles in September, an increase of 598% year-on-year.

Horizontal analysis, whether it is a new car power or traditional new energy brands will lose money. Data analytics, in the first half of this year, NIO, ideal, Xiaopeng lost 4.54 billion yuan, 652 million yuan and 4.402 billion yuan respectively; traditional new energy Aian 2019 – 2022 During the period of May 31, the cumulative net loss was 3.70 billion yuan. As of the end of May this year, the company’s total debt was as high as 9.85 billion yuan, which means that from the advent of Aian to the present, it has not been profitable; Geely’s high-end pure electric electrode krypton lost 759 million yuan in the first half of this year, accounting for nearly 50% of Geely Group’s net profit.

However, Wei Xiaoli, Ai’an and Extreme Krypton despite losses but their sales are passable. According to the data of the Passenger Federation, in the first 9 months, the cumulative sales of GAC Ai’an 182,300 vehicles, an increase of 132% year-on-year; Xiaopeng, Ideal and NIO sold 98,600 vehicles, 86,900 vehicles and 82,400 vehicles respectively in the first 9 months; Extreme Krypton delivered less than a year to break through the 50,000 vehicle target.

Look at it this way, call yourself the "national team"The Lan Tu was obviously a little powerless. The current performance of the Lan Tu might be something Dongfeng had never imagined.

"Success is also the east wind, defeat is also the east wind"

The Landscape is the work of Dongfeng, and Dongfeng continues to empower the Landscape.

In July 2020, Dongfeng Motor’s new high-end electric brand "Lantu" was officially released, aiming to create a "true zero-anxiety high-end smart electric brand"; and an independent company "Yoyah" was established. On June 19, 2021, Lantu FREE, the first model of Lantu, was officially launched.

Yu Zheng, a member of Dongfeng’s standing committee and deputy general manager, said: "Yoyah will adopt a new organizational mechanism as a new force in China’s automobile manufacturing, with a new team and a new business model, to provide users with a high-end smart electric experience with zero anxiety. Lantu Automobile will also lead Dongfeng’s brand upward and the development trend of the 3.0 era."

In the development of Landscape, Dongfeng gave it great autonomy.

"Daily Report" noted that in order to avoid the historical burden left by traditional car companies caused redundancy and improve efficiency, Landmap has been operating independently since its birth, Dongfeng established a separate Landmap business department, the former Dongfeng strategic planning department special project technical director Lu Fang served as the chief executive officer and chief technical officer of Yoyah; the former Dongfeng Infiniti executive deputy general manager Lei Xin served as the chief brand officer, mainly new company market operation, brand operation, innovation ecology and commodity planning; the former Dongfeng Nissan Dalian branch general manager Jiang Tao served as the chief operating officer to assist Lu Fang in charge of the company’s daily operations; the former Dongfeng company finance reporting branch manager Shen Jun served as the chief financial officer.

Even if it is an office location, Lantu has moved from the Dongfeng Technology Center at No. 663 Zhushanhu Avenue in Wuhan to the artificial intelligence technology park at No. 81 Checheng South Road, Wuhan Economic Development Zone.

Although Lantu is independent in terms of organizational structure, it still relies on Dongfeng Group, which has a 50-year history of car manufacturing. The first is the R & D and manufacturing in the field of "three power"; since 2001, Dongfeng has established Dongfeng electric vehicle joint stock company. In 2017, Dongfeng officially proposed the "five modernizations" strategy, that is, lightweight, electrification, intelligence, networking, sharing, and carried out a comprehensive layout; in 2019, Dongfeng established Zhixin Technology joint stock company.

At the same time, with the endorsement of Dongfeng Group,Landmap is also favored by many suppliers, including Huawei, Tencent, iFLYTEK, CATL, Magna, Bosch and other first-line suppliers.

Lu Fang once described Lantu in an interview as "Lantu is to Dongfeng what Shenzhen was to China at the beginning of reform and opening up."

Picture source: Photo by reporter Sun Tongtong (data map)

However, "providing users with a zero-anxiety experience" has given users a lot of anxiety. Many car owners have reported that the Lantu FREE has quality defects, including engine failure, electric drive controller failure, sudden not leaving during driving, glass leakage and other quality defects.

Recently, a car owner who purchased Lantu FREE on June 7 questioned the quality defects of Lantu FREE. The user said that less than 5 days after picking up the car, the new car had a low battery voltage and the vehicle briefly shook out of control when reversing; 10 days later, the vehicle shook violently again out of control; the delivery center maintenance staff informed the owner that the vehicle had a drive motor controller (MCU) failure, and the MCU should be disassembled and replaced as a whole, and then the vehicle should be debugged. And explained that the low battery voltage is a software bug in the charging module, which needs to be upgraded to solve.

This sparked dissatisfaction from users, who said that "there is false propaganda in Landmap. Landmap cars use maintenance to solve faults instead of returning and exchanging vehicles. This practice is extremely arrogant, extremely irresponsible, and damages the legitimate rights and interests of consumers."

As early as the beginning of this year, some car owners complained that the Landmap FREE model they purchased had lost power, lost direction, and the vehicle was "lying down" during driving for only one month, and the staff of Landmap sales outlets refused to return the car, but the video was later deleted.

To some extent, the image is the last wish of Dongfeng independent brand upward breakthrough, Dongfeng accomplished the whole task at one stroke, but obviously the image did not meet the expectations of Dongfeng, so Dongfeng began to protect himself.

"Qian Jing" unknown, financing listing

NIO CEO Li Bin once said that "if there is no 20 billion, don’t build a car", and later said that "now there is no 40 billion may not be able to do it".

In 2021, Dongfeng Group achieved a profit of 11.39 billion yuan for the whole year, which means that even if Dongfeng Group uses the annual profit to "support" Landmap, there is a lot of pressure.

As early as 2020, after the advent of Landmap, Dongfeng Group wants to list on the Shenzhen Stock Exchange growth enterprises market and return to class A shares.At that time, the group said that if the funds raised by the issuance of class A shares would be used for the development of new brand high-end new energy passenger vehicle projects, the implication was to be Landscape, but Dongfeng Group, which "stepped into" the growth enterprises market, eventually "died without a disease".

However, the latest news shows that Dongfeng Group submitted a report on the progress of counseling to the local securities regulatory bureau in January and April this year, and is currently cooperating with intermediaries to start listing counseling.

Dongfeng’s "lack of money" is inevitable. There are two paths in front of Dongfeng, either Lantu listing and financing, or Dongfeng listing and financing.

On October 17, Dongfeng Motor Joint Stock Company announced that Dongfeng Motor Group Joint Stock Company has acquired 502 million shares in accordance with the tender offer conditions of the Dongfeng Motor Joint Stock Company Offer Takeover Report, with a total share capital ratio of 25.1%, and has fulfilled relevant obligations in accordance with the relevant provisions of the Shanghai Stock Exchange and the Shanghai Branch of China Securities Depository and Clearing Co., Ltd.

As of October 14, the liquidation and transfer procedures for this tender offer were completed, and Dongfeng Group Co., Ltd. held a total of 1.10 billion shares of Dongfeng shares, accounting for 55% of its total share capital, and had absolute control.

According to industry analysts, the reason for the acquisition of Dongfeng Motor shares is that Dongfeng Group wants to use it to pave the way for listing, commonly known as "backdoor listing", but it is not known whether it is for itself or for Landmap.

In fact, Landmap was also listed on the Shanghai United Equity Exchange at the end of September to start an external equity capital increase, which means that Dongfeng Group is willing to give up part of its corporate ownership to introduce new shareholders to bring capital in. Before the capital increase, 89.66% of Landmap Automobile’s equity was held by Dongfeng Group, and the remaining 10.34% was held by employees. If the capital increase is completed, it is expected that Dongfeng Group will hold no less than 77% of the equity, and strategic investors will hold no more than 15% of the total equity.

However, from the market information, investors have not yet thrown an olive branch, the acquisition of Dongfeng Motor joint stock company equity or another move of Dongfeng Group.

As early as July this year, Lantu made the largest personnel adjustment since its establishment. Specifically, Lantu CEO Lu Fang no longer serves as the Chief Technology Officer (CTO), which is held by Wang Junjun, deputy director of the DONGFENG MOTOR CORPORATION Technology Center. In addition, Qin Jie served as the interim party committee member and party secretary of Lantu Automobile;Liu Mingjiao served as a temporary party committee member, disciplinary committee member, and secretary of the disciplinary committee of Lantu Automobile; Gong Xuesong and Shao Mingfeng served as assistant general manager of Lantu Automobile.

This also revealed that Dongfeng Group tried to inject fresh blood into the Landmap management team to make up for its dissatisfaction.

On August 27, Dongfeng Group officially launched the electric off-road brand Warrior, which is positioned as a high-end electric off-road brand and belongs to the "M brand". This is the second electric brand released by Dongfeng Group after Lantu. As early as the 2021 Shanghai Auto Show, Dongfeng Group launched the "M brand", replicating the way Lantu started, and Cao Dongjie, deputy general manager of Dongfeng passenger cars, served as the CEO of the "M business department".

Don’t ask what Dongfeng Group’s intention is, only for Lantu, a new energy brand, Dongfeng Group is a little difficult, and it is unknown whether it can create a new electric brand.

Zhong Shi, an automotive analyst, once said: "Although Dongfeng has an advantage in the military off-road market, there is huge competition in the civilian market to directly launch electric off-road. After all, the Tank 300 has received good market feedback."

It is undeniable that Lantu has started very quickly, but its current performance may be a drag on the parent company, and Dongfeng Group is also looking for a way out for itself. Recently, Lantu released its first car "Chasing Light", but the "blueprint" has not yet been realized, and it is unknown whether "Chasing Light" can take it out of the darkness.

Cover image source: Every reporter Sun Tongtong photo (data map)